- South Korea

- /

- Consumer Durables

- /

- KOSDAQ:A071460

Is WINIADIMCHAE Co.,Ltd.'s (KOSDAQ:071460) ROE Of 23% Impressive?

One of the best investments we can make is in our own knowledge and skill set. With that in mind, this article will work through how we can use Return On Equity (ROE) to better understand a business. To keep the lesson grounded in practicality, we'll use ROE to better understand WINIADIMCHAE Co.,Ltd. (KOSDAQ:071460).

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for WINIADIMCHAELtd

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for WINIADIMCHAELtd is:

23% = ₩28b ÷ ₩120b (Based on the trailing twelve months to September 2020).

The 'return' is the income the business earned over the last year. That means that for every ₩1 worth of shareholders' equity, the company generated ₩0.23 in profit.

Does WINIADIMCHAELtd Have A Good Return On Equity?

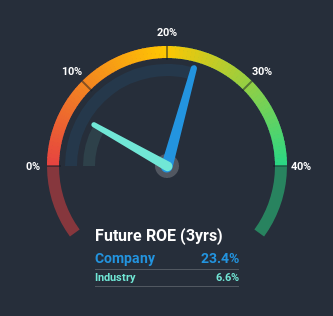

One simple way to determine if a company has a good return on equity is to compare it to the average for its industry. However, this method is only useful as a rough check, because companies do differ quite a bit within the same industry classification. As is clear from the image below, WINIADIMCHAELtd has a better ROE than the average (6.6%) in the Consumer Durables industry.

That's what we like to see. With that said, a high ROE doesn't always indicate high profitability. Especially when a firm uses high levels of debt to finance its debt which may boost its ROE but the high leverage puts the company at risk. You can see the 3 risks we have identified for WINIADIMCHAELtd by visiting our risks dashboard for free on our platform here.

The Importance Of Debt To Return On Equity

Virtually all companies need money to invest in the business, to grow profits. That cash can come from issuing shares, retained earnings, or debt. In the case of the first and second options, the ROE will reflect this use of cash, for growth. In the latter case, the debt required for growth will boost returns, but will not impact the shareholders' equity. Thus the use of debt can improve ROE, albeit along with extra risk in the case of stormy weather, metaphorically speaking.

Combining WINIADIMCHAELtd's Debt And Its 23% Return On Equity

WINIADIMCHAELtd does use a high amount of debt to increase returns. It has a debt to equity ratio of 1.38. While its ROE is pretty respectable, the amount of debt the company is carrying currently is not ideal. Debt does bring extra risk, so it's only really worthwhile when a company generates some decent returns from it.

Summary

Return on equity is useful for comparing the quality of different businesses. Companies that can achieve high returns on equity without too much debt are generally of good quality. All else being equal, a higher ROE is better.

But when a business is high quality, the market often bids it up to a price that reflects this. It is important to consider other factors, such as future profit growth -- and how much investment is required going forward. Check the past profit growth by WINIADIMCHAELtd by looking at this visualization of past earnings, revenue and cash flow.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

If you decide to trade WINIADIMCHAELtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if WINIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A071460

WINIA

Manufactures and sells home appliances in Korea and internationally.

Moderate and slightly overvalued.

Market Insights

Community Narratives