- South Korea

- /

- Consumer Durables

- /

- KOSDAQ:A060570

Dreamus (KOSDAQ:060570 investor five-year losses grow to 64% as the stock sheds ₩15b this past week

Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. Zooming in on an example, the Dreamus Company (KOSDAQ:060570) share price dropped 64% in the last half decade. That is extremely sub-optimal, to say the least. Unfortunately the share price momentum is still quite negative, with prices down 18% in thirty days.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Dreamus moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

The revenue decline of 0.01% isn't too bad. But it's quite possible the market had expected better; a closer look at the revenue trends might explain the pessimism.

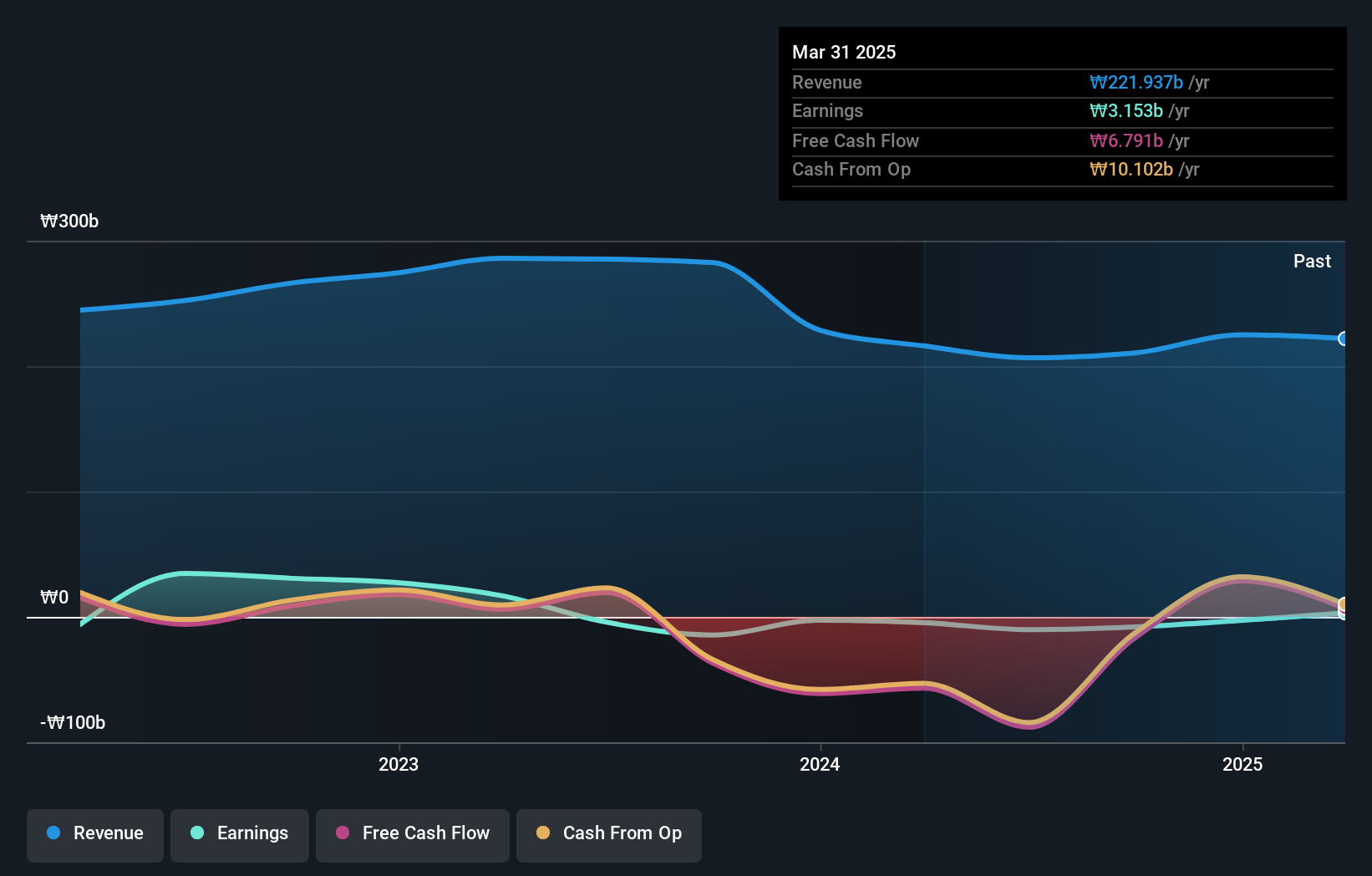

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Dreamus shareholders are down 7.7% for the year, but the market itself is up 20%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 10% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Dreamus you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A060570

Dreamus

Manufactures audio equipment and electronic parts in South Korea and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives