- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A028300

Can You Imagine How Elated HLB's (KOSDAQ:028300) Shareholders Feel About Its 486% Share Price Gain?

Buying shares in the best businesses can build meaningful wealth for you and your family. While not every stock performs well, when investors win, they can win big. For example, the HLB Co., Ltd. (KOSDAQ:028300) share price is up a whopping 486% in the last half decade, a handsome return for long term holders. If that doesn't get you thinking about long term investing, we don't know what will. Meanwhile the share price is 3.2% higher than it was a week ago.

Check out our latest analysis for HLB

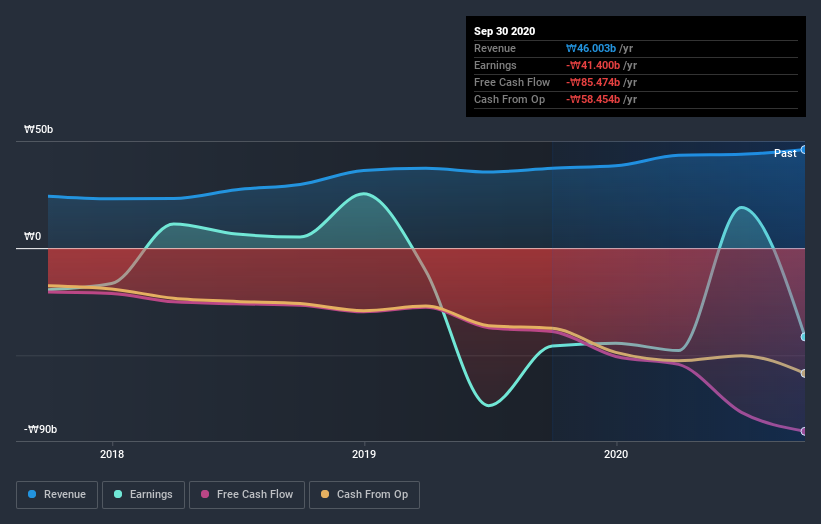

Given that HLB didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, HLB can boast revenue growth at a rate of 4.3% per year. Put simply, that growth rate fails to impress. Therefore, we're a little surprised to see the share price gain has been so strong, at 42% per year, compound, over the period. We don't think the growth over the period is that great, but it could be that faster growth appears to some to be on the horizon. Having said that, a closer look at the numbers might surface good reasons to believe that profits will gush in the future.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling HLB stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between HLB's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. HLB hasn't been paying dividends, but its TSR of 501% exceeds its share price return of 486%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

HLB shareholders gained a total return of 15% during the year. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 43% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for HLB (1 doesn't sit too well with us) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade HLB, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HLB might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A028300

HLB

Manufactures and constructs lifeboats and glass fiber pipes in South Korea and internationally.

Adequate balance sheet with minimal risk.

Market Insights

Community Narratives