- South Korea

- /

- Professional Services

- /

- KOSE:A094280

Hyosung ITX (KRX:094280) Will Pay A Dividend Of ₩150.00

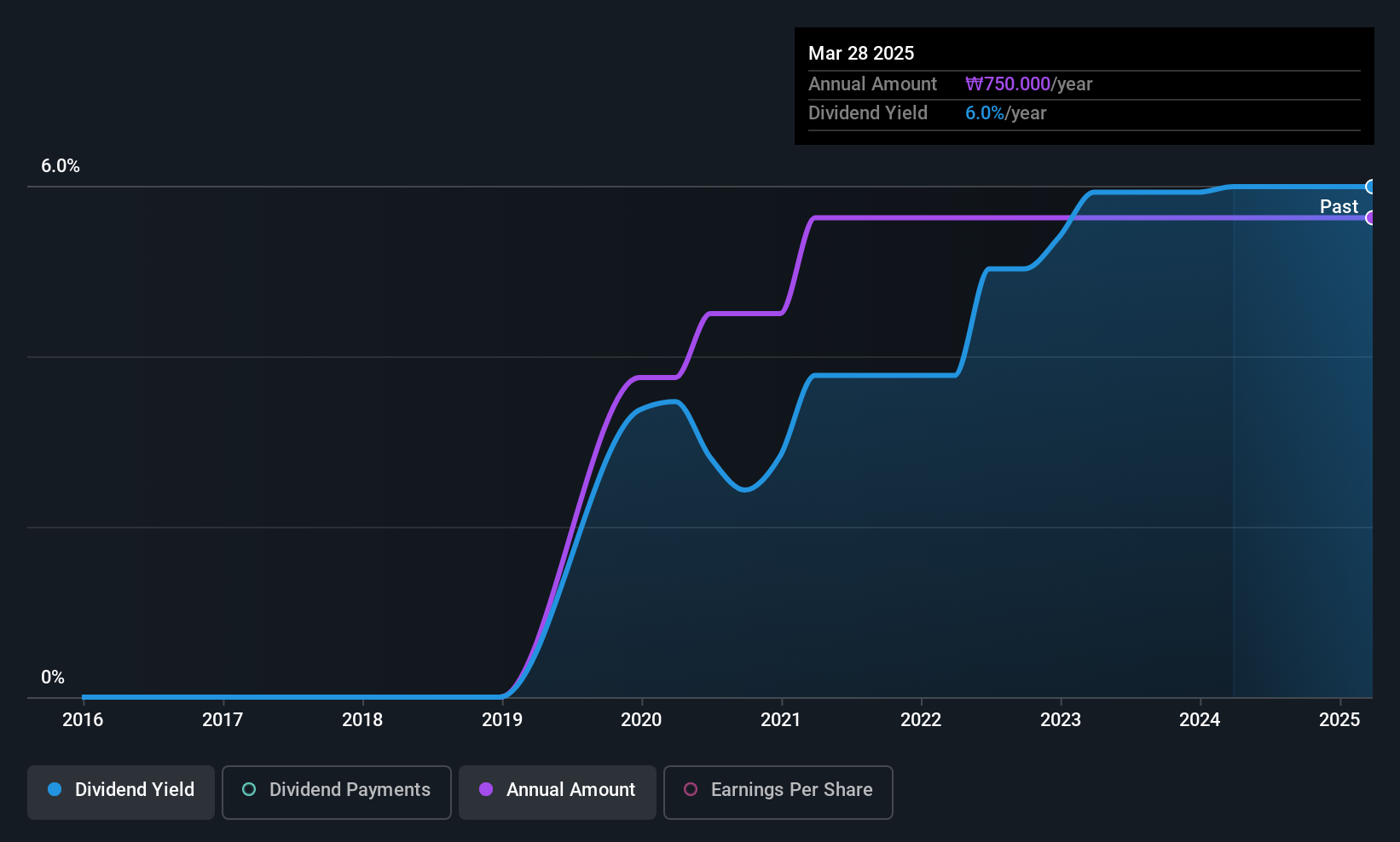

Hyosung ITX Co. Ltd (KRX:094280) will pay a dividend of ₩150.00 on the 13th of August. This means the annual payment is 6.0% of the current stock price, which is above the average for the industry.

Estimates Indicate Hyosung ITX's Could Struggle to Maintain Dividend Payments In The Future

A big dividend yield for a few years doesn't mean much if it can't be sustained. The last payment made up 83% of earnings, but cash flows were much higher. This leaves plenty of cash for reinvestment into the business.

If the company can't turn things around, EPS could fall by 2.0% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could reach 96%, which could put the dividend in jeopardy if the company's earnings don't improve.

Check out our latest analysis for Hyosung ITX

Hyosung ITX Doesn't Have A Long Payment History

Hyosung ITX's dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. The annual payment during the last 6 years was ₩500.00 in 2019, and the most recent fiscal year payment was ₩750.00. This works out to be a compound annual growth rate (CAGR) of approximately 7.0% a year over that time. Hyosung ITX has been growing its dividend at a decent rate, and the payments have been stable. However, the payment history is very short, so there is no evidence yet that the dividend can be sustained over a full economic cycle.

The Dividend's Growth Prospects Are Limited

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Let's not jump to conclusions as things might not be as good as they appear on the surface. However, Hyosung ITX's EPS was effectively flat over the past five years, which could stop the company from paying more every year.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 1 warning sign for Hyosung ITX that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Hyosung ITX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A094280

Hyosung ITX

Provides contact center services and IT solutions in South Korea.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026