- South Korea

- /

- Commercial Services

- /

- KOSE:A051600

3 Asian Dividend Stocks To Consider With Yields Up To 5.1%

Reviewed by Simply Wall St

As global markets navigate through trade uncertainties and economic policy shifts, Asian markets have been capturing attention with their resilience and potential for growth. In this context, dividend stocks in Asia present an intriguing opportunity for investors seeking stable income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.95% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.85% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.41% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.08% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.81% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.57% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.07% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.24% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.47% | ★★★★★★ |

Click here to see the full list of 1226 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

KEPCO Plant Service & EngineeringLtd (KOSE:A051600)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KEPCO Plant Service & Engineering Co., Ltd. operates in the maintenance and repair of power plants and has a market cap of ₩1.90 trillion.

Operations: KEPCO Plant Service & Engineering Co., Ltd. generates revenue from business services amounting to ₩1.56 trillion.

Dividend Yield: 5.1%

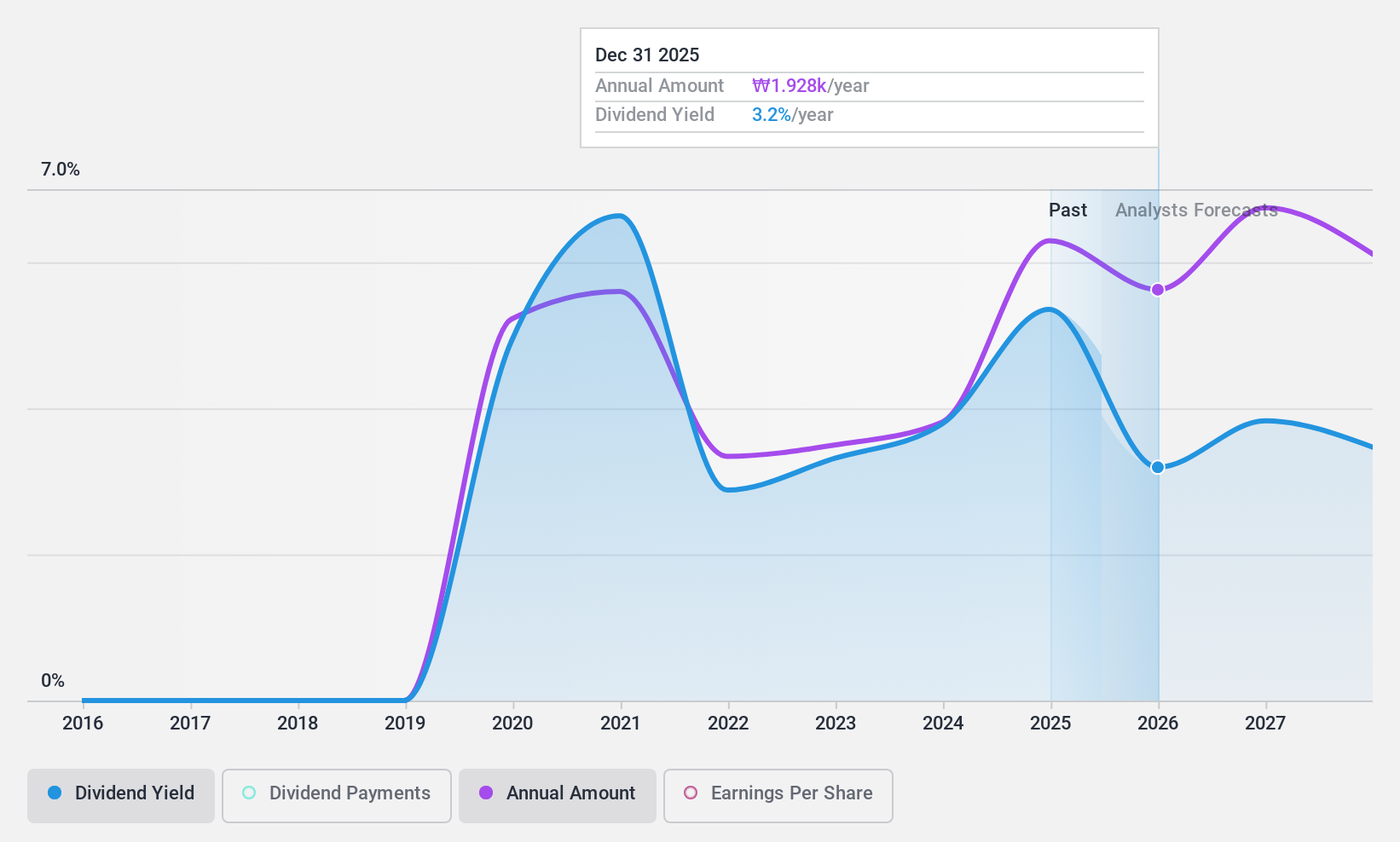

KEPCO Plant Service & Engineering Ltd. offers a dividend yield of 5.11%, placing it in the top 25% of KR market payers, though its six-year dividend history is marked by volatility and an unstable track record. Despite this, dividends are well-covered with a payout ratio of 53% and cash payout ratio of 19.9%. The stock trades at good value relative to peers and below fair value estimates, with analysts optimistic about future price increases.

- Get an in-depth perspective on KEPCO Plant Service & EngineeringLtd's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, KEPCO Plant Service & EngineeringLtd's share price might be too pessimistic.

Teikoku Tsushin Kogyo (TSE:6763)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teikoku Tsushin Kogyo Co., Ltd. operates in the electronic components sector, serving both domestic and international markets, with a market cap of ¥21.33 billion.

Operations: Teikoku Tsushin Kogyo Co., Ltd. generates revenue through its diverse range of electronic components offered to both local and global markets.

Dividend Yield: 3.1%

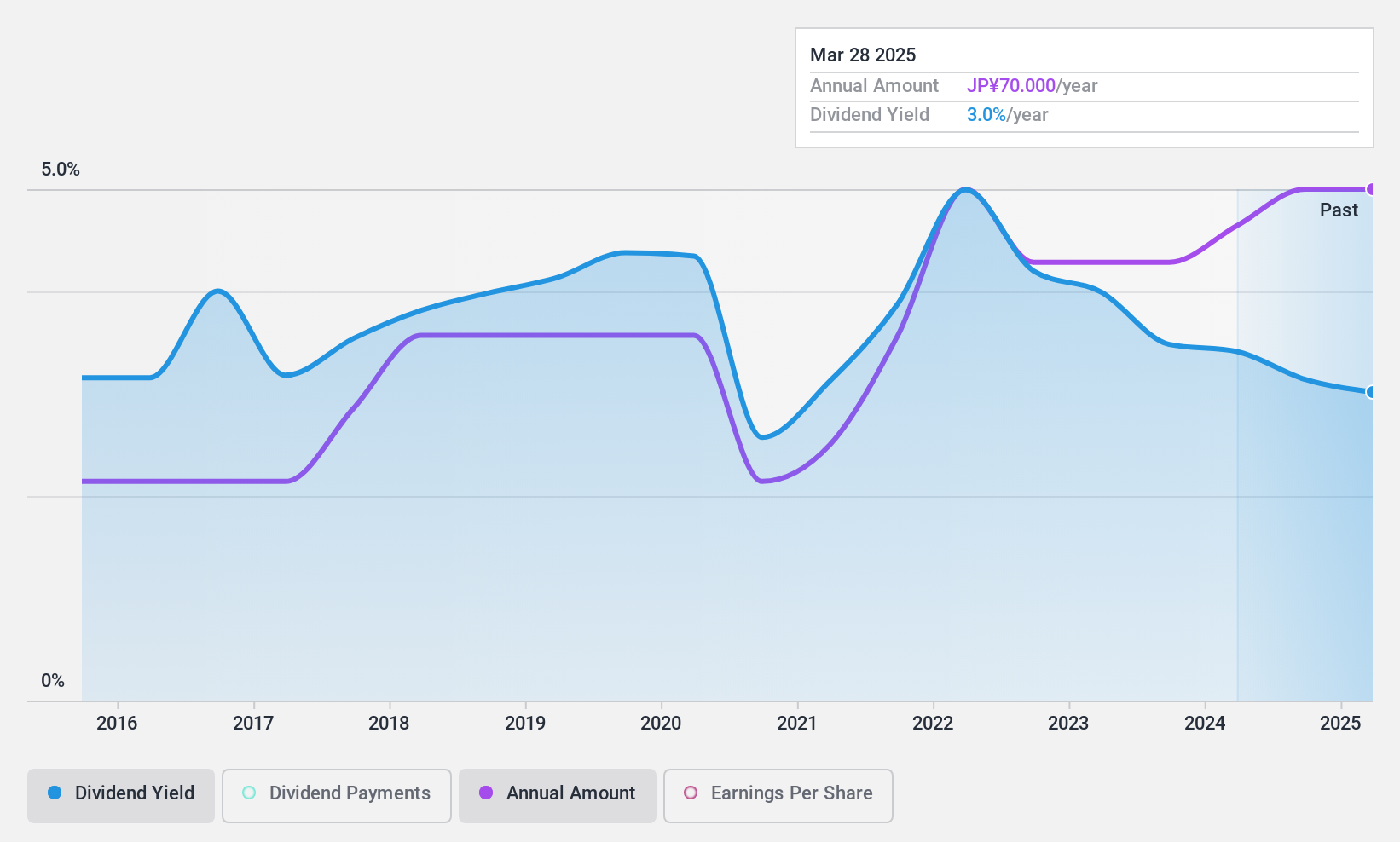

Teikoku Tsushin Kogyo's dividend reliability is mixed, with recent affirmations maintaining a JPY 35.00 per share payout and a special JPY 15.00 commemorative dividend for fiscal year ending March 2025. Despite past volatility, dividends are covered by earnings (38.8% payout ratio) and cash flows (89.7% cash payout ratio). The company's profit growth of 29.1% last year supports these payouts, though its yield of 3.09% lags behind top-tier JP market payers.

- Take a closer look at Teikoku Tsushin Kogyo's potential here in our dividend report.

- Our valuation report here indicates Teikoku Tsushin Kogyo may be overvalued.

Futaba Industrial (TSE:7241)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Futaba Industrial Co., Ltd. is a company that manufactures and sells automotive parts, information environment equipment, external sales equipment, and agricultural equipment both in Japan and internationally, with a market cap of ¥68.55 billion.

Operations: Futaba Industrial Co., Ltd.'s revenue segments are comprised of ¥50.69 billion from Asia, ¥69.90 billion from China, ¥329.20 billion from Japan, ¥63.62 billion from Europe, and ¥210.32 billion from North America.

Dividend Yield: 4.6%

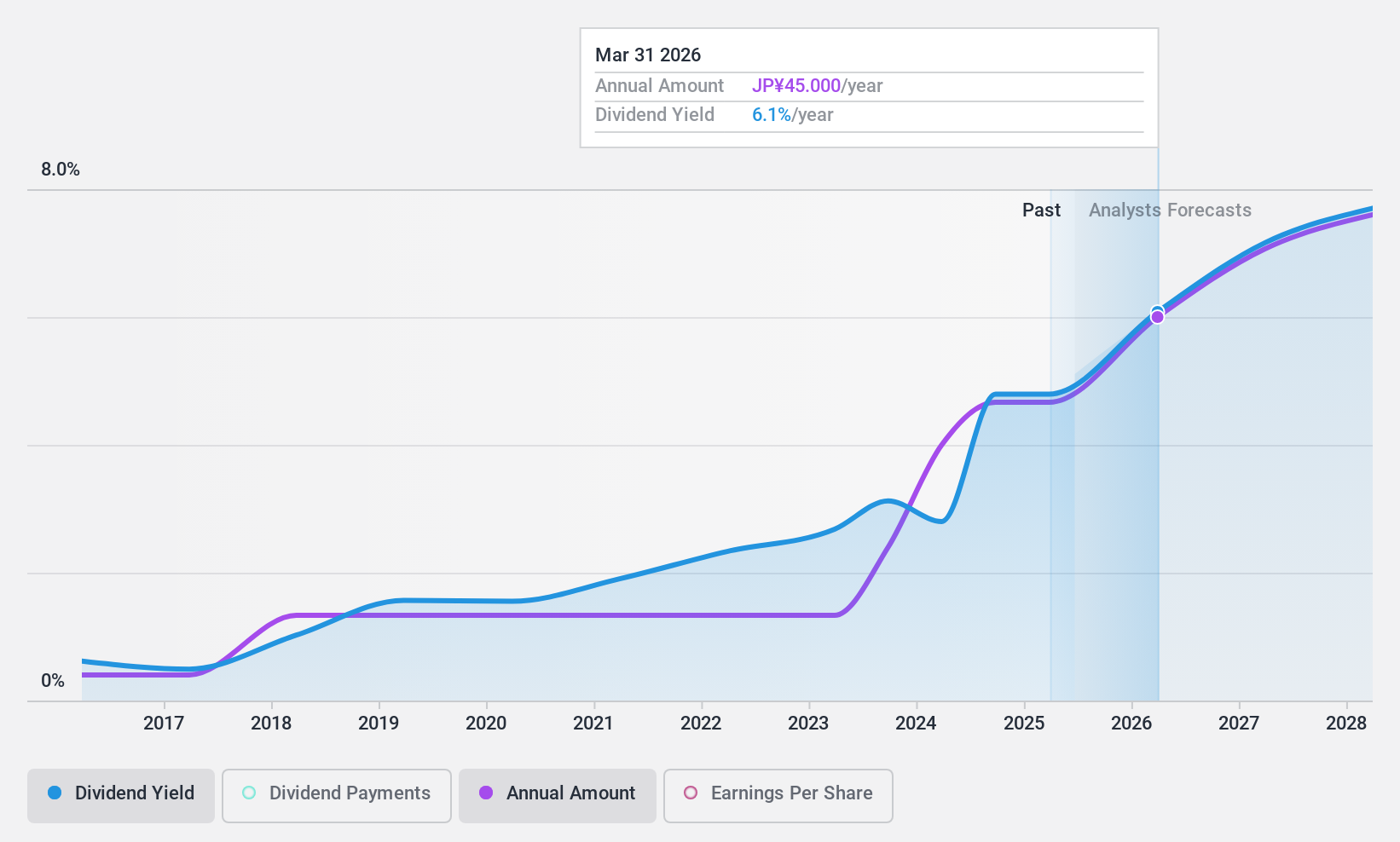

Futaba Industrial's dividend yield of 4.57% ranks in the top 25% of JP market payers, supported by a stable and reliable payout history over the past decade. The company's dividends are well-covered by cash flows, with a low cash payout ratio of 20.5%, and earnings coverage remains sustainable at a 68.1% payout ratio despite recent profit margin declines from last year’s figures. Additionally, it trades significantly below estimated fair value, enhancing its attractiveness as a dividend stock.

- Dive into the specifics of Futaba Industrial here with our thorough dividend report.

- The analysis detailed in our Futaba Industrial valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Get an in-depth perspective on all 1226 Top Asian Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KEPCO Plant Service & EngineeringLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A051600

KEPCO Plant Service & EngineeringLtd

KEPCO Plant Service & Engineering Co.,Ltd.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives