- South Korea

- /

- Professional Services

- /

- KOSE:A030190

The Underlying Trends At NICE Information Service (KOSDAQ:030190) Look Strong

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Ergo, when we looked at the ROCE trends at NICE Information Service (KOSDAQ:030190), we liked what we saw.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for NICE Information Service, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.22 = ₩56b ÷ (₩332b - ₩80b) (Based on the trailing twelve months to June 2020).

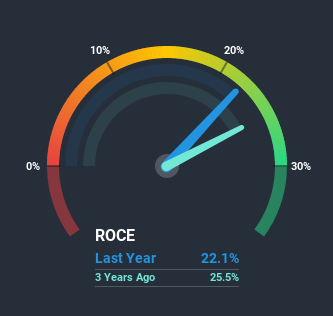

So, NICE Information Service has an ROCE of 22%. That's a fantastic return and not only that, it outpaces the average of 9.3% earned by companies in a similar industry.

View our latest analysis for NICE Information Service

Above you can see how the current ROCE for NICE Information Service compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering NICE Information Service here for free.

How Are Returns Trending?

It's hard not to be impressed by NICE Information Service's returns on capital. The company has employed 88% more capital in the last five years, and the returns on that capital have remained stable at 22%. Now considering ROCE is an attractive 22%, this combination is actually pretty appealing because it means the business can consistently put money to work and generate these high returns. You'll see this when looking at well operated businesses or favorable business models.

What We Can Learn From NICE Information Service's ROCE

In short, we'd argue NICE Information Service has the makings of a multi-bagger since its been able to compound its capital at very profitable rates of return. On top of that, the stock has rewarded shareholders with a remarkable 145% return to those who've held over the last five years. So while investors seem to be recognizing these promising trends, we still believe the stock deserves further research.

While NICE Information Service looks impressive, no company is worth an infinite price. The intrinsic value infographic in our free research report helps visualize whether A030190 is currently trading for a fair price.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

If you decide to trade NICE Information Service, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NICE Information Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A030190

NICE Information Service

Provides credit evaluation, credit inquiries, credit investigations, and debt collection services in South Korea.

Undervalued with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026