- South Korea

- /

- Aerospace & Defense

- /

- KOSE:A272210

Subdued Growth No Barrier To Hanwha Systems Co., Ltd. (KRX:272210) With Shares Advancing 26%

Despite an already strong run, Hanwha Systems Co., Ltd. (KRX:272210) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 191% following the latest surge, making investors sit up and take notice.

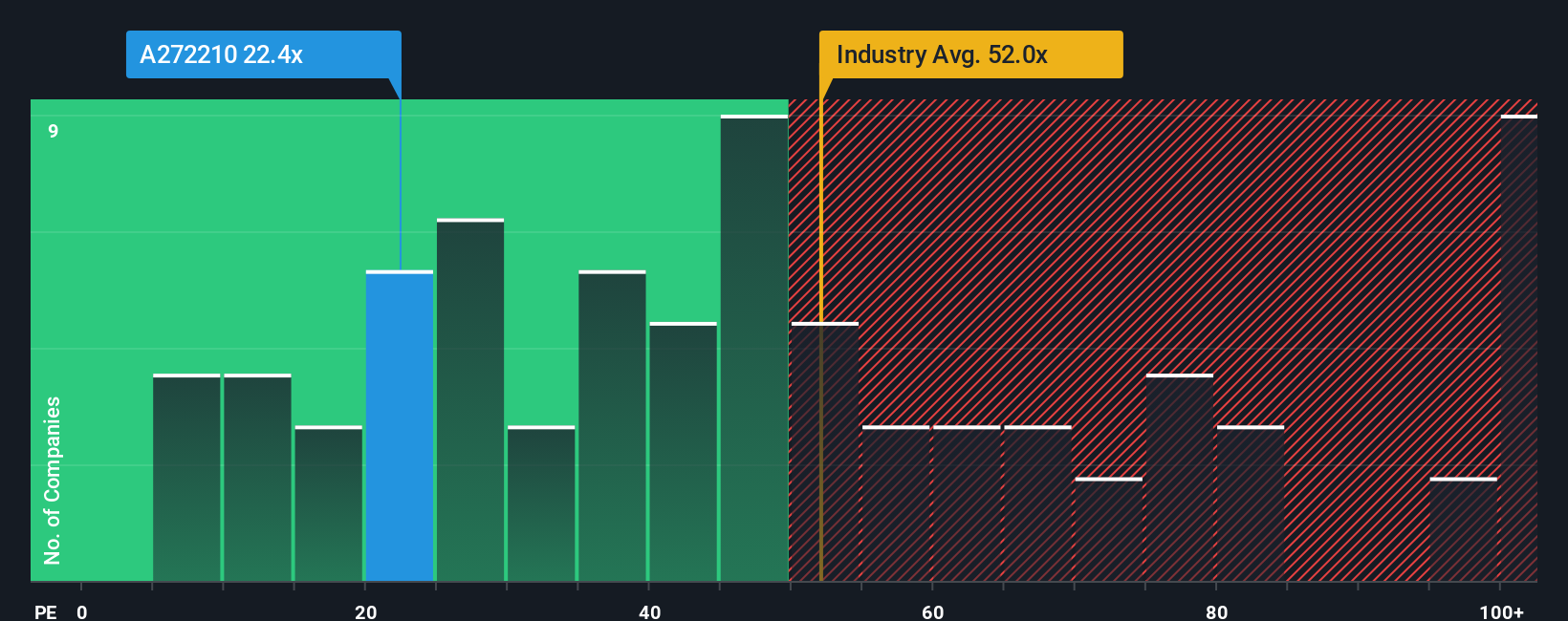

Since its price has surged higher, Hanwha Systems may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 22.4x, since almost half of all companies in Korea have P/E ratios under 12x and even P/E's lower than 7x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Hanwha Systems certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Hanwha Systems

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Hanwha Systems' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 72% last year. The latest three year period has also seen an excellent 386% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 6.5% per year during the coming three years according to the analysts following the company. Meanwhile, the broader market is forecast to expand by 17% per year, which paints a poor picture.

In light of this, it's alarming that Hanwha Systems' P/E sits above the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Key Takeaway

The strong share price surge has got Hanwha Systems' P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Hanwha Systems' analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Hanwha Systems (1 is a bit unpleasant) you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Hanwha Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A272210

Hanwha Systems

Hanwha Systems Co., Ltd. manufacture and sell various military equipments in South Korea and internationally.

Proven track record and fair value.

Market Insights

Community Narratives