Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that DY Power Corporation (KRX:210540) is about to go ex-dividend in just 3 days. You will need to purchase shares before the 29th of December to receive the dividend, which will be paid on the 20th of April.

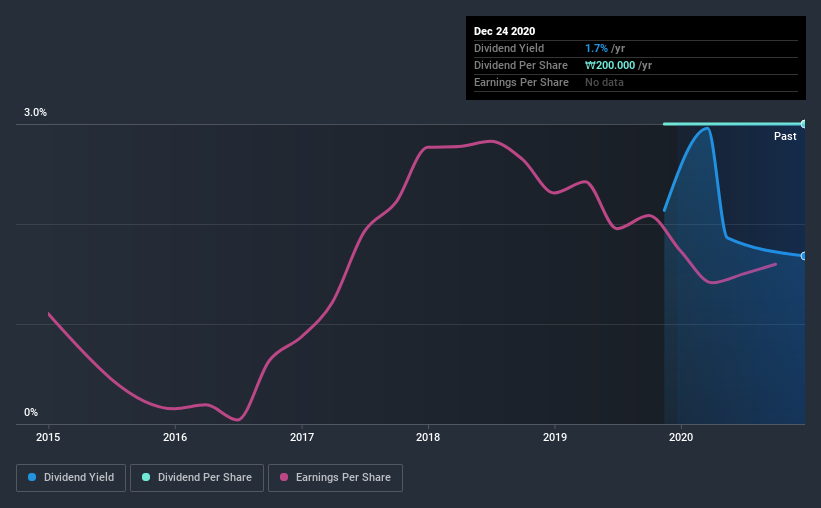

DY Power's upcoming dividend is ₩200 a share, following on from the last 12 months, when the company distributed a total of ₩200 per share to shareholders. Based on the last year's worth of payments, DY Power stock has a trailing yield of around 1.7% on the current share price of ₩11900. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether DY Power has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for DY Power

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. DY Power has a low and conservative payout ratio of just 13% of its income after tax. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. The good news is it paid out just 6.5% of its free cash flow in the last year.

It's positive to see that DY Power's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit DY Power paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're encouraged by the steady growth at DY Power, with earnings per share up 7.7% on average over the last five years. Earnings per share have been growing at a decent rate, and the company is retaining more than three-quarters of its earnings in the business. This is an attractive combination, because when profits are reinvested effectively, growth can compound, with corresponding benefits for earnings and dividends in the future.

Unfortunately DY Power has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

The Bottom Line

Should investors buy DY Power for the upcoming dividend? Earnings per share growth has been growing somewhat, and DY Power is paying out less than half its earnings and cash flow as dividends. This is interesting for a few reasons, as it suggests management may be reinvesting heavily in the business, but it also provides room to increase the dividend in time. We would prefer to see earnings growing faster, but the best dividend stocks over the long term typically combine significant earnings per share growth with a low payout ratio, and DY Power is halfway there. DY Power looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

So while DY Power looks good from a dividend perspective, it's always worthwhile being up to date with the risks involved in this stock. For example - DY Power has 1 warning sign we think you should be aware of.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade DY Power, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A210540

DY Power

Engages in production and sales of hydraulic cylinders for construction equipment in Korea.

Flawless balance sheet and good value.

Market Insights

Community Narratives