- South Korea

- /

- Machinery

- /

- KOSE:A145210

Some Confidence Is Lacking In Dynamic Design Co., LTD. (KRX:145210) As Shares Slide 36%

Dynamic Design Co., LTD. (KRX:145210) shares have had a horrible month, losing 36% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 23% in that time.

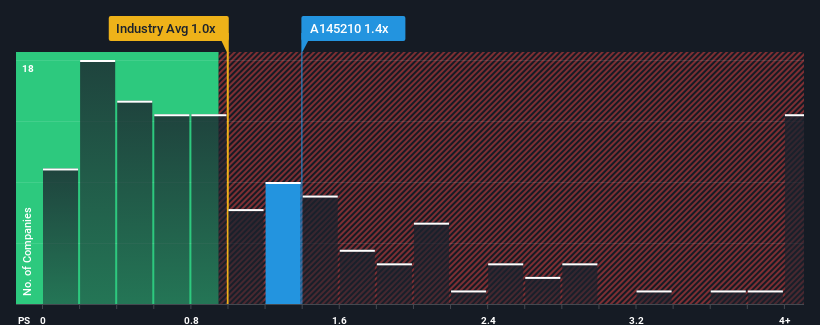

Even after such a large drop in price, there still wouldn't be many who think Dynamic Design's price-to-sales (or "P/S") ratio of 1.4x is worth a mention when the median P/S in Korea's Machinery industry is similar at about 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Dynamic Design

How Dynamic Design Has Been Performing

We'd have to say that with no tangible growth over the last year, Dynamic Design's revenue has been unimpressive. Perhaps the market believes the recent run-of-the-mill revenue performance isn't enough to outperform the industry, which has kept the P/S muted. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Dynamic Design will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Dynamic Design?

Dynamic Design's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 1.9% decline in revenue over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 35% shows it's an unpleasant look.

With this information, we find it concerning that Dynamic Design is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Final Word

Dynamic Design's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Dynamic Design revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It is also worth noting that we have found 3 warning signs for Dynamic Design (2 are significant!) that you need to take into consideration.

If you're unsure about the strength of Dynamic Design's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A145210

Dynamic Design

Primarily engages in the manufacture and sale of tire molds forming machines in Korea, China, the Americas, Europe, and Indonesia.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives