- South Korea

- /

- Machinery

- /

- KOSE:A079900

Junjin Construction and Robot Co.,Ltd.'s (KRX:079900) Shares Climb 32% But Its Business Is Yet to Catch Up

Junjin Construction and Robot Co.,Ltd. (KRX:079900) shares have continued their recent momentum with a 32% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

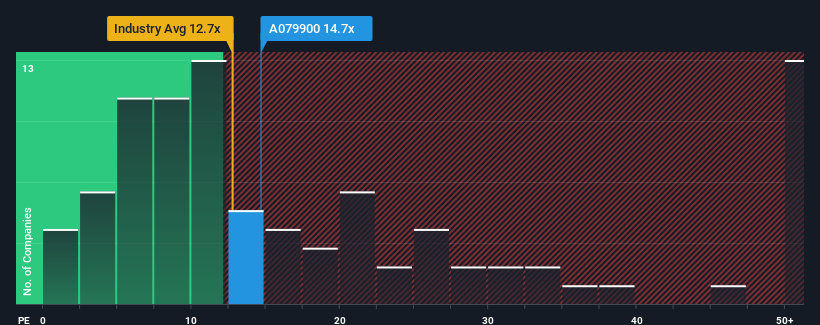

Since its price has surged higher, Junjin Construction and RobotLtd may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 14.7x, since almost half of all companies in Korea have P/E ratios under 11x and even P/E's lower than 6x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Junjin Construction and RobotLtd has been doing a decent job lately as it's been growing earnings at a reasonable pace. One possibility is that the P/E is high because investors think this good earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Junjin Construction and RobotLtd

Is There Enough Growth For Junjin Construction and RobotLtd?

There's an inherent assumption that a company should outperform the market for P/E ratios like Junjin Construction and RobotLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 2.6% gain to the company's bottom line. Still, lamentably EPS has fallen 24% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 32% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that Junjin Construction and RobotLtd's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

Junjin Construction and RobotLtd shares have received a push in the right direction, but its P/E is elevated too. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Junjin Construction and RobotLtd revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Junjin Construction and RobotLtd that you should be aware of.

You might be able to find a better investment than Junjin Construction and RobotLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A079900

Junjin Construction and RobotLtd

Junjin Construction & Robot Co., Ltd. manufactures and sells construction equipment in South Korea and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion