- South Korea

- /

- Machinery

- /

- KOSE:A079900

Junjin Construction and Robot Co.,Ltd.'s (KRX:079900) 26% Price Boost Is Out Of Tune With Earnings

Junjin Construction and Robot Co.,Ltd. (KRX:079900) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

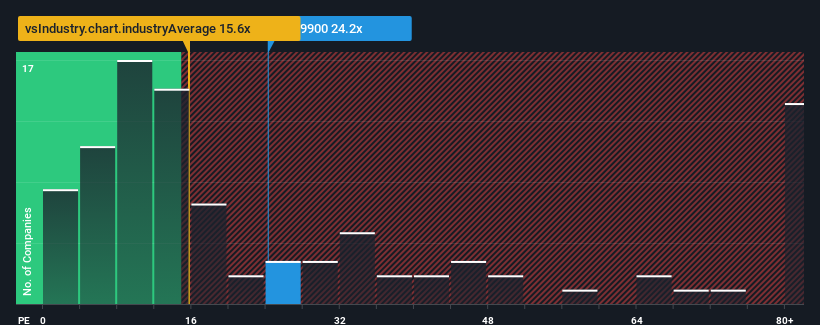

Following the firm bounce in price, Junjin Construction and RobotLtd's price-to-earnings (or "P/E") ratio of 24.2x might make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 12x and even P/E's below 6x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Our free stock report includes 2 warning signs investors should be aware of before investing in Junjin Construction and RobotLtd. Read for free now.There hasn't been much to differentiate Junjin Construction and RobotLtd's and the market's earnings growth lately. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Junjin Construction and RobotLtd

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Junjin Construction and RobotLtd would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a worthy increase of 6.3%. However, this wasn't enough as the latest three year period has seen an unpleasant 21% overall drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 2.5% over the next year. Meanwhile, the rest of the market is forecast to expand by 19%, which is noticeably more attractive.

With this information, we find it concerning that Junjin Construction and RobotLtd is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Junjin Construction and RobotLtd's P/E?

The strong share price surge has got Junjin Construction and RobotLtd's P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Junjin Construction and RobotLtd's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 2 warning signs we've spotted with Junjin Construction and RobotLtd.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A079900

Junjin Construction and RobotLtd

Junjin Construction & Robot Co., Ltd. manufactures and sells construction equipment in South Korea and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives