Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Enplus Co., Ltd. (KRX:074610) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Enplus

What Is Enplus's Net Debt?

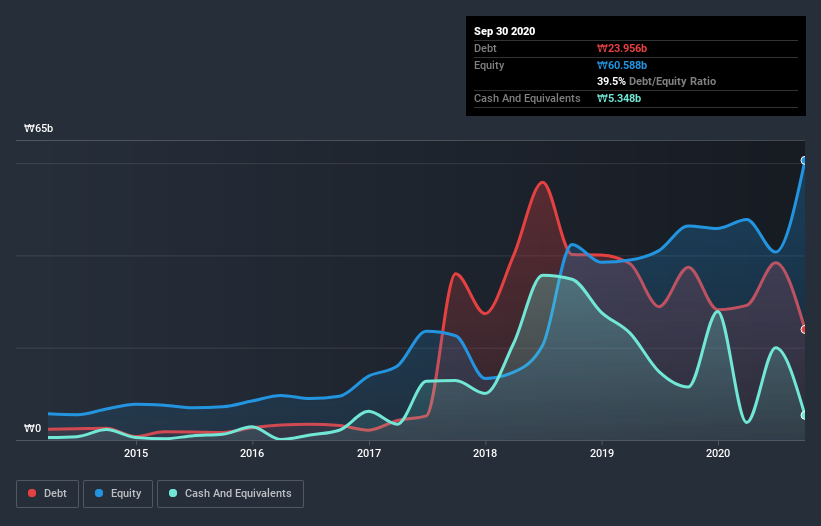

The image below, which you can click on for greater detail, shows that Enplus had debt of ₩24.0b at the end of September 2020, a reduction from ₩37.4b over a year. However, because it has a cash reserve of ₩5.35b, its net debt is less, at about ₩18.6b.

How Healthy Is Enplus' Balance Sheet?

The latest balance sheet data shows that Enplus had liabilities of ₩32.6b due within a year, and liabilities of ₩6.70b falling due after that. Offsetting these obligations, it had cash of ₩5.35b as well as receivables valued at ₩6.05b due within 12 months. So its liabilities total ₩27.9b more than the combination of its cash and short-term receivables.

Given Enplus has a market capitalization of ₩170.3b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Enplus will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Enplus wasn't profitable at an EBIT level, but managed to grow its revenue by 90%, to ₩49b. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

Despite the top line growth, Enplus still had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost ₩7.0b at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled ₩2.8b in negative free cash flow over the last twelve months. So to be blunt we think it is risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for Enplus you should be aware of, and 1 of them doesn't sit too well with us.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Enplus, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ENPLUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A074610

Slight and slightly overvalued.

Market Insights

Community Narratives