Stock Analysis

- South Korea

- /

- Machinery

- /

- KOSE:A071970

Even though STX Heavy Industries (KRX:071970) has lost ₩49b market cap in last 7 days, shareholders are still up 296% over 5 years

The STX Heavy Industries Co., Ltd. (KRX:071970) share price has had a bad week, falling 10%. But in stark contrast, the returns over the last half decade have impressed. It's fair to say most would be happy with 296% the gain in that time. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Ultimately business performance will determine whether the stock price continues the positive long term trend.

While the stock has fallen 10% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

View our latest analysis for STX Heavy Industries

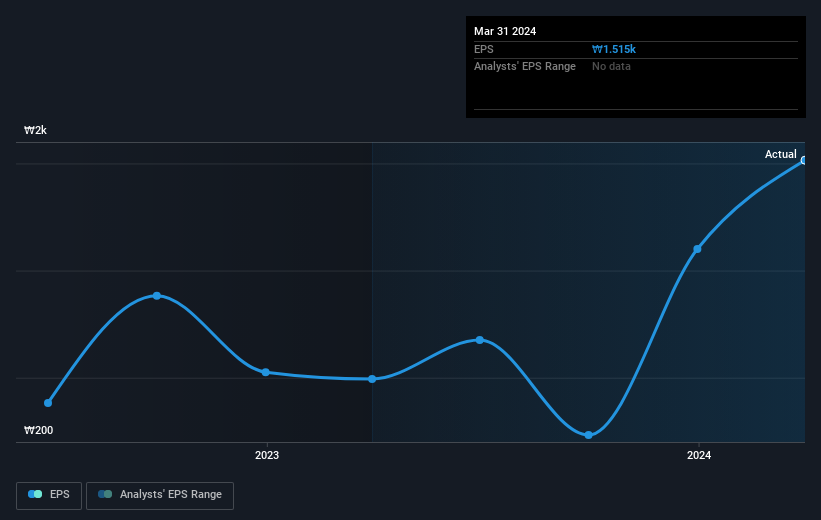

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, STX Heavy Industries became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into STX Heavy Industries' key metrics by checking this interactive graph of STX Heavy Industries's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that STX Heavy Industries shareholders have received a total shareholder return of 186% over the last year. That's better than the annualised return of 32% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before deciding if you like the current share price, check how STX Heavy Industries scores on these 3 valuation metrics.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether STX Heavy Industries is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A071970

STX Heavy Industries

Manufactures and sells marine engines, industrial facilities, and plants in South Korea and internationally.

Solid track record with excellent balance sheet.