- South Korea

- /

- Machinery

- /

- KOSE:A071970

There's Reason For Concern Over HD-Hyundai Marine Engine Co., Ltd.'s (KRX:071970) Massive 27% Price Jump

Despite an already strong run, HD-Hyundai Marine Engine Co., Ltd. (KRX:071970) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days were the cherry on top of the stock's 403% gain in the last year, which is nothing short of spectacular.

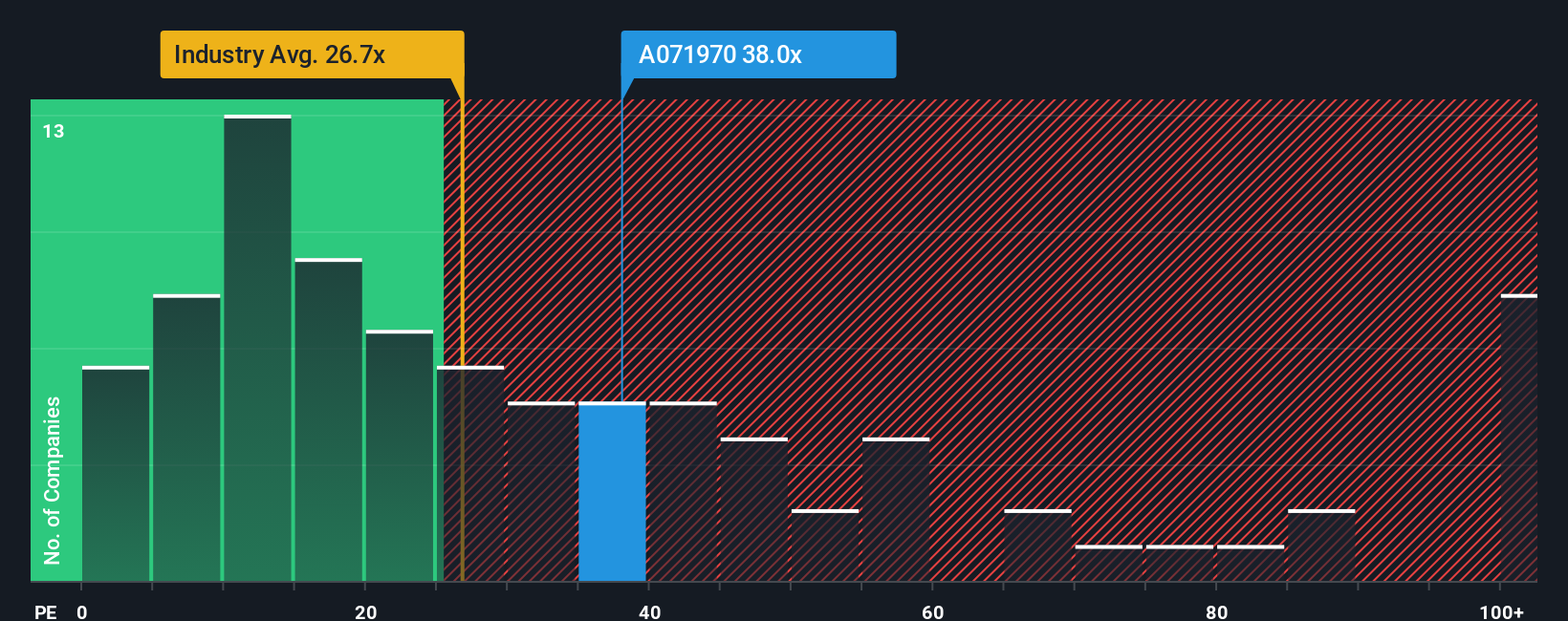

After such a large jump in price, HD-Hyundai Marine Engine's price-to-earnings (or "P/E") ratio of 38x might make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 14x and even P/E's below 7x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been pleasing for HD-Hyundai Marine Engine as its earnings have risen in spite of the market's earnings going into reverse. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for HD-Hyundai Marine Engine

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like HD-Hyundai Marine Engine's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 68% last year. The strong recent performance means it was also able to grow EPS by 595% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 17% per annum during the coming three years according to the four analysts following the company. That's shaping up to be similar to the 19% per annum growth forecast for the broader market.

In light of this, it's curious that HD-Hyundai Marine Engine's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On HD-Hyundai Marine Engine's P/E

Shares in HD-Hyundai Marine Engine have built up some good momentum lately, which has really inflated its P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of HD-Hyundai Marine Engine's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It is also worth noting that we have found 1 warning sign for HD-Hyundai Marine Engine that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if HD-Hyundai Marine Engine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A071970

HD-Hyundai Marine Engine

Manufactures and sells marine engines, industrial facilities, and plants in South Korea and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives