- South Korea

- /

- Machinery

- /

- KOSE:A042670

Doosan Infracore's (KRX:042670) Shareholders Have More To Worry About Than Only Soft Earnings

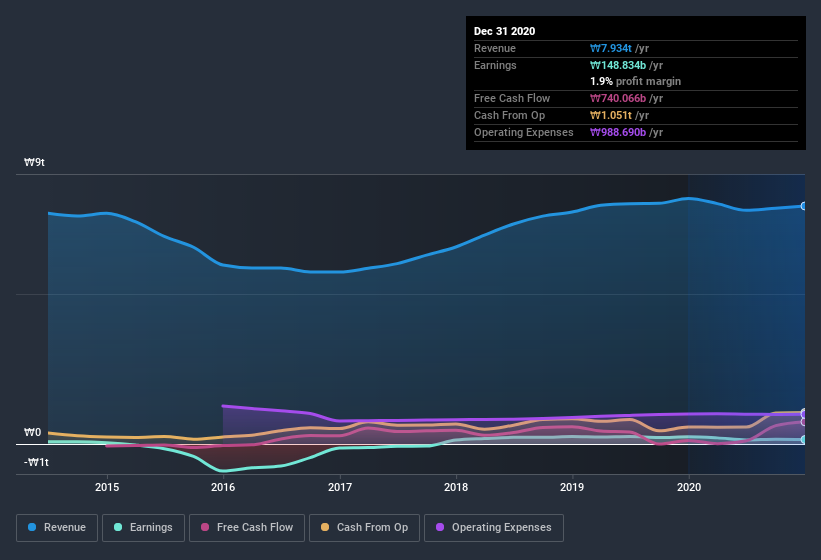

Investors were disappointed by Doosan Infracore Co., Ltd.'s (KRX:042670 ) latest earnings release. We did some analysis, and found that there are some reasons to be cautious about the headline numbers.

Check out our latest analysis for Doosan Infracore

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Doosan Infracore increased the number of shares on issue by 5.5% over the last twelve months by issuing new shares. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Doosan Infracore's EPS by clicking here.

A Look At The Impact Of Doosan Infracore's Dilution on Its Earnings Per Share (EPS).

As you can see above, Doosan Infracore has been growing its net income over the last few years, with an annualized gain of 14% over three years. Net profit actually dropped by 38% in the last year. But the EPS result was even worth, with the company recording a decline of 39%. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, if Doosan Infracore's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Doosan Infracore's Profit Performance

Over the last year Doosan Infracore issued new shares and so, there's a noteworthy divergence between EPS and net income growth. Therefore, it seems possible to us that Doosan Infracore's true underlying earnings power is actually less than its statutory profit. But at least holders can take some solace from the 12% per annum growth in EPS for the last three. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you want to do dive deeper into Doosan Infracore, you'd also look into what risks it is currently facing. Case in point: We've spotted 4 warning signs for Doosan Infracore you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Doosan Infracore's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Doosan Infracore or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HD Hyundai Infracore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A042670

HD Hyundai Infracore

Engages in the manufacture and sale of industrial machinery and equipment in Korea, North America, Asia, Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives