- South Korea

- /

- Electrical

- /

- KOSE:A034020

Doosan Enerbility (KRX:034020) shareholder returns have been fantastic, earning 527% in 5 years

Long term investing can be life changing when you buy and hold the truly great businesses. While not every stock performs well, when investors win, they can win big. For example, the Doosan Enerbility Co., Ltd. (KRX:034020) share price is up a whopping 502% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. In more good news, the share price has risen 37% in thirty days. But this could be related to good market conditions -- stocks in its market are up 18% in the last month. We love happy stories like this one. The company should be really proud of that performance!

The past week has proven to be lucrative for Doosan Enerbility investors, so let's see if fundamentals drove the company's five-year performance.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Doosan Enerbility has made a profit in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. So it might be better to look at other metrics to try to understand the share price.

On the other hand, Doosan Enerbility's revenue is growing nicely, at a compound rate of 12% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

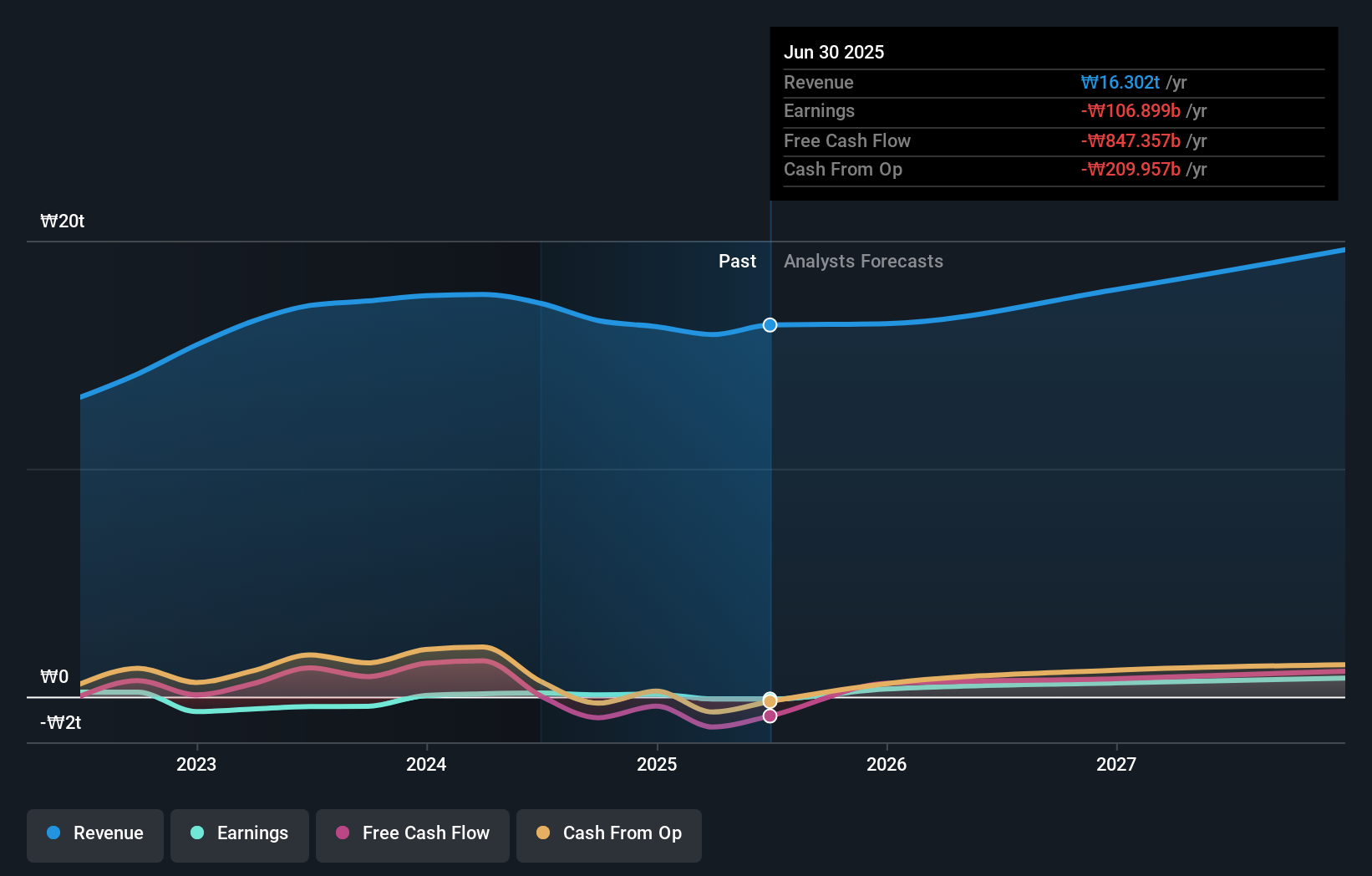

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Doosan Enerbility is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Doosan Enerbility in this interactive graph of future profit estimates.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Doosan Enerbility's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Doosan Enerbility shareholders, and that cash payout contributed to why its TSR of 527%, over the last 5 years, is better than the share price return.

A Different Perspective

It's nice to see that Doosan Enerbility shareholders have received a total shareholder return of 295% over the last year. That gain is better than the annual TSR over five years, which is 44%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Doosan Enerbility better, we need to consider many other factors. For example, we've discovered 1 warning sign for Doosan Enerbility that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A034020

Doosan Enerbility

Operates as an energy company in South Korea, the Americas, Asia, the Middle East, Europe, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives