- South Korea

- /

- Electrical

- /

- KOSE:A034020

Doosan Enerbility Co., Ltd.'s (KRX:034020) 37% Share Price Surge Not Quite Adding Up

The Doosan Enerbility Co., Ltd. (KRX:034020) share price has done very well over the last month, posting an excellent gain of 37%. The annual gain comes to 295% following the latest surge, making investors sit up and take notice.

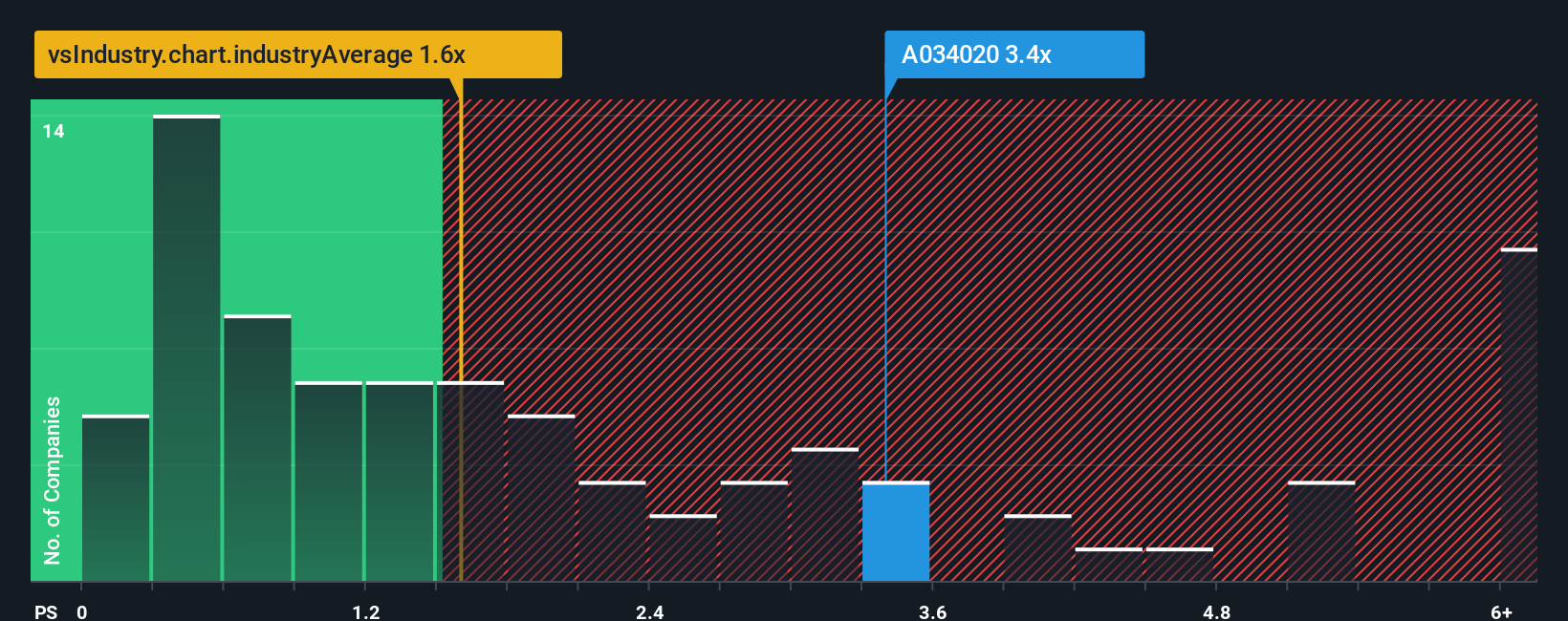

After such a large jump in price, you could be forgiven for thinking Doosan Enerbility is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.4x, considering almost half the companies in Korea's Electrical industry have P/S ratios below 1.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Doosan Enerbility

How Has Doosan Enerbility Performed Recently?

Recent times have been more advantageous for Doosan Enerbility as its revenue hasn't fallen as much as the rest of the industry. Perhaps the market is expecting the company to continue to outperform the industry, which has propped up the P/S. While you'd prefer that its revenue trajectory turned around, you'd at least be hoping it remains less negative than other companies, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Doosan Enerbility's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Doosan Enerbility's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.5%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 24% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 9.0% each year during the coming three years according to the analysts following the company. With the industry predicted to deliver 20% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Doosan Enerbility's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Doosan Enerbility's P/S?

The large bounce in Doosan Enerbility's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Doosan Enerbility, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

Having said that, be aware Doosan Enerbility is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Doosan Enerbility's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A034020

Doosan Enerbility

Operates as an energy company in South Korea, the Americas, Asia, the Middle East, Europe, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives