- South Korea

- /

- Construction

- /

- KOSE:A023960

SC Engineering's (KRX:023960) Performance Is Even Better Than Its Earnings Suggest

The subdued stock price reaction suggests that SC Engineering Co., Ltd's (KRX:023960) strong earnings didn't offer any surprises. Investors are probably missing some underlying factors which are encouraging for the future of the company.

Our free stock report includes 2 warning signs investors should be aware of before investing in SC Engineering. Read for free now.

A Closer Look At SC Engineering's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

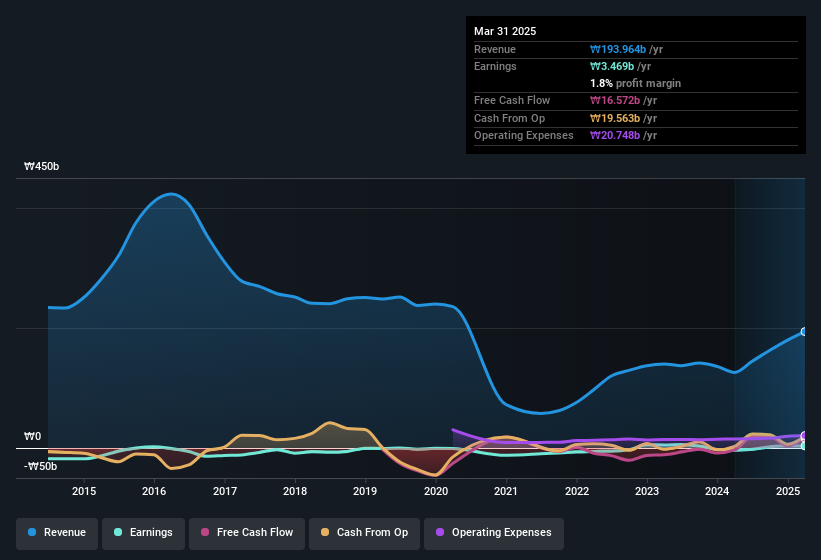

Over the twelve months to March 2025, SC Engineering recorded an accrual ratio of -0.38. That indicates that its free cash flow quite significantly exceeded its statutory profit. To wit, it produced free cash flow of ₩17b during the period, dwarfing its reported profit of ₩3.47b. Notably, SC Engineering had negative free cash flow last year, so the ₩17b it produced this year was a welcome improvement. Having said that, there is more to consider. We must also consider the impact of unusual items on statutory profit (and thus the accrual ratio), as well as note the ramifications of the company issuing new shares.

See our latest analysis for SC Engineering

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of SC Engineering.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, SC Engineering increased the number of shares on issue by 6.7% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out SC Engineering's historical EPS growth by clicking on this link.

A Look At The Impact Of SC Engineering's Dilution On Its Earnings Per Share (EPS)

SC Engineering was losing money three years ago. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if SC Engineering's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

The Impact Of Unusual Items On Profit

SC Engineering's profit was reduced by unusual items worth ₩1.5b in the last twelve months, and this helped it produce high cash conversion, as reflected by its unusual items. In a scenario where those unusual items included non-cash charges, we'd expect to see a strong accrual ratio, which is exactly what has happened in this case. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect SC Engineering to produce a higher profit next year, all else being equal.

Our Take On SC Engineering's Profit Performance

In conclusion, both SC Engineering's accrual ratio and its unusual items suggest that its statutory earnings are probably reasonably conservative, but the dilution means that per-share performance is weaker than the statutory profit numbers imply. Looking at all these factors, we'd say that SC Engineering's underlying earnings power is at least as good as the statutory numbers would make it seem. So while earnings quality is important, it's equally important to consider the risks facing SC Engineering at this point in time. Every company has risks, and we've spotted 2 warning signs for SC Engineering you should know about.

Our examination of SC Engineering has focussed on certain factors that can make its earnings look better than they are. And it has passed with flying colours. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A023960

SC Engineering

Operates as an engineering company in South Korea and internationally.

Mediocre balance sheet and overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion