- South Korea

- /

- Machinery

- /

- KOSE:A015230

Individual investors who hold 47% of Daechang Forging Co., Ltd. (KRX:015230) gained 11%, insiders profited as well

Key Insights

- The considerable ownership by individual investors in Daechang Forging indicates that they collectively have a greater say in management and business strategy

- 52% of the business is held by the top 6 shareholders

- 45% of Daechang Forging is held by insiders

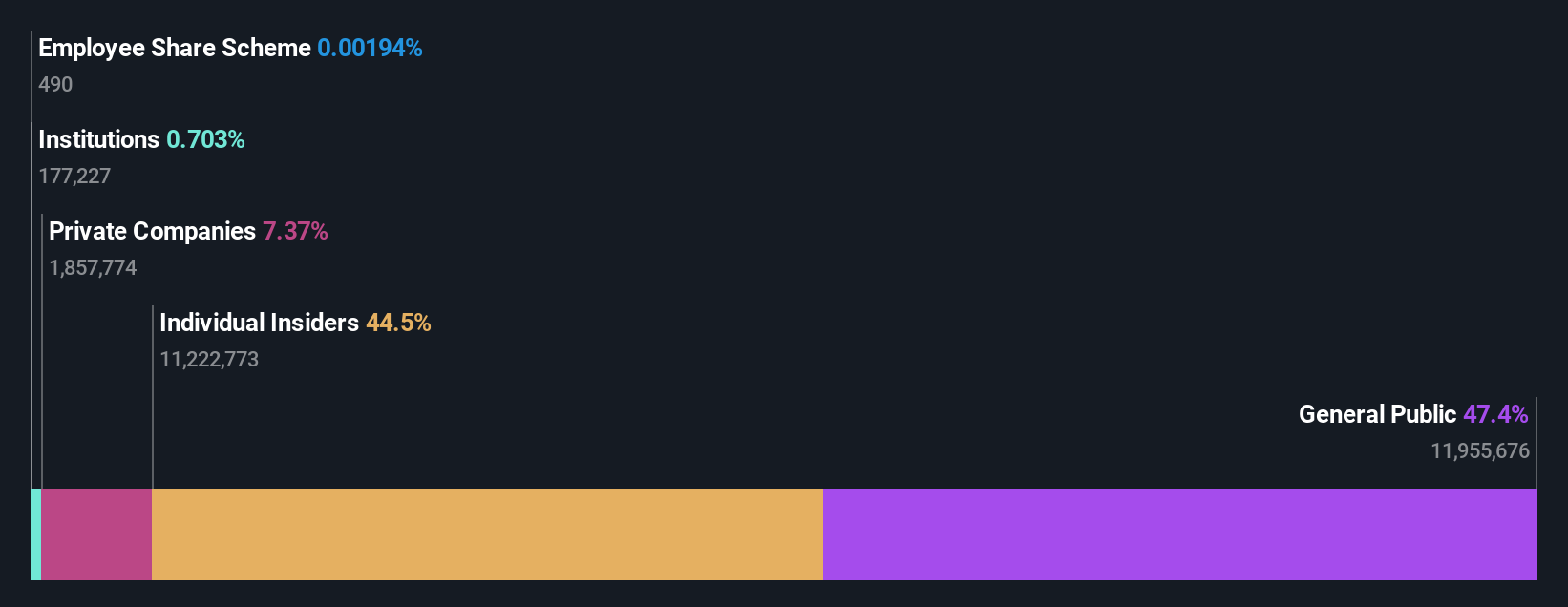

To get a sense of who is truly in control of Daechang Forging Co., Ltd. (KRX:015230), it is important to understand the ownership structure of the business. With 47% stake, individual investors possess the maximum shares in the company. Put another way, the group faces the maximum upside potential (or downside risk).

Following a 11% increase in the stock price last week, individual investors profited the most, but insiders who own 45% stock also stood to gain from the increase.

In the chart below, we zoom in on the different ownership groups of Daechang Forging.

See our latest analysis for Daechang Forging

What Does The Lack Of Institutional Ownership Tell Us About Daechang Forging?

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. Alternatively, there might be something about the company that has kept institutional investors away. Daechang Forging's earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

Hedge funds don't have many shares in Daechang Forging. With a 23% stake, CEO Kwon-Il Park is the largest shareholder. With 15% and 5.3% of the shares outstanding respectively, Kwon-Wook Park and DCF Trek Co., Ltd. are the second and third largest shareholders. Interestingly, the second-largest shareholder, Kwon-Wook Park is also Senior Key Executive, again, pointing towards strong insider ownership amongst the company's top shareholders.

We also observed that the top 6 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Daechang Forging

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our information suggests that insiders maintain a significant holding in Daechang Forging Co., Ltd.. It has a market capitalization of just ₩175b, and insiders have ₩78b worth of shares in their own names. We would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public-- including retail investors -- own 47% stake in the company, and hence can't easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

We can see that Private Companies own 7.4%, of the shares on issue. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

Many find it useful to take an in depth look at how a company has performed in the past. You can access this detailed graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A015230

Daechang Forging

Manufactures and sells various forged products in South Korea and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives