- South Korea

- /

- Construction

- /

- KOSE:A010780

We Think IS DongSeo (KRX:010780) Is Taking Some Risk With Its Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that IS DongSeo Co., Ltd. (KRX:010780) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for IS DongSeo

What Is IS DongSeo's Debt?

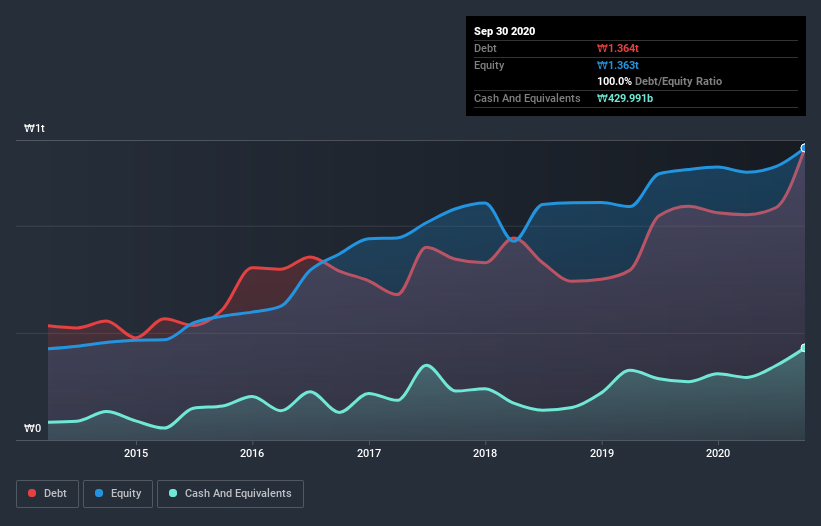

As you can see below, at the end of September 2020, IS DongSeo had ₩1.36t of debt, up from ₩1.09t a year ago. Click the image for more detail. However, it also had ₩430.0b in cash, and so its net debt is ₩933.5b.

How Healthy Is IS DongSeo's Balance Sheet?

According to the last reported balance sheet, IS DongSeo had liabilities of ₩1.16t due within 12 months, and liabilities of ₩843.7b due beyond 12 months. On the other hand, it had cash of ₩430.0b and ₩282.8b worth of receivables due within a year. So it has liabilities totalling ₩1.29t more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of ₩1.63t, so it does suggest shareholders should keep an eye on IS DongSeo's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

IS DongSeo has a debt to EBITDA ratio of 4.7 and its EBIT covered its interest expense 4.1 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. However, one redeeming factor is that IS DongSeo grew its EBIT at 17% over the last 12 months, boosting its ability to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine IS DongSeo's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, IS DongSeo recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

On the face of it, IS DongSeo's net debt to EBITDA left us tentative about the stock, and its conversion of EBIT to free cash flow was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at growing its EBIT; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making IS DongSeo stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 4 warning signs for IS DongSeo (1 is significant!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading IS DongSeo or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A010780

IS DongSeo

Engages in the construction and construction materials businesses in South Korea.

Fair value with moderate growth potential.

Market Insights

Community Narratives