The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, IS DongSeo Co., Ltd. (KRX:010780) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for IS DongSeo

What Is IS DongSeo's Net Debt?

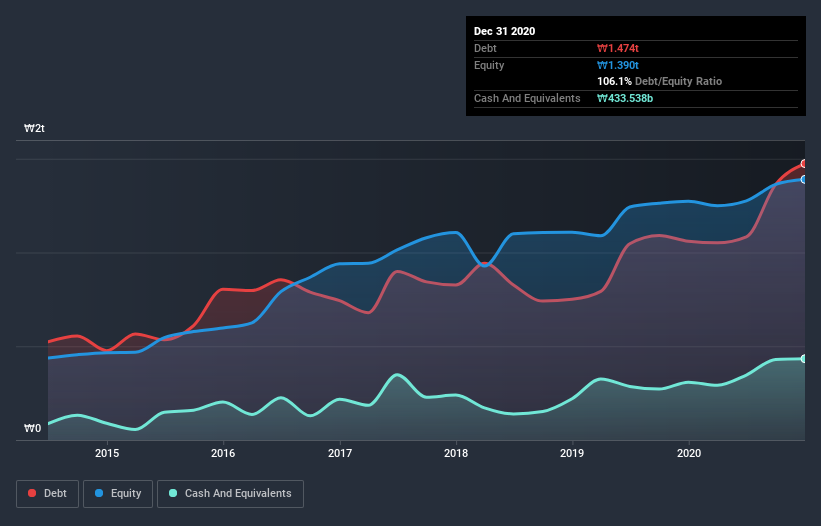

As you can see below, at the end of December 2020, IS DongSeo had ₩1.47t of debt, up from ₩1.06t a year ago. Click the image for more detail. However, it does have ₩433.5b in cash offsetting this, leading to net debt of about ₩1.04t.

How Strong Is IS DongSeo's Balance Sheet?

According to the last reported balance sheet, IS DongSeo had liabilities of ₩1.16t due within 12 months, and liabilities of ₩1.07t due beyond 12 months. Offsetting this, it had ₩433.5b in cash and ₩410.0b in receivables that were due within 12 months. So it has liabilities totalling ₩1.39t more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of ₩1.72t, so it does suggest shareholders should keep an eye on IS DongSeo's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

IS DongSeo has a debt to EBITDA ratio of 4.0 and its EBIT covered its interest expense 4.6 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Notably, IS DongSeo's EBIT launched higher than Elon Musk, gaining a whopping 192% on last year. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine IS DongSeo's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, IS DongSeo recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

Mulling over IS DongSeo's attempt at converting EBIT to free cash flow, we're certainly not enthusiastic. But at least it's pretty decent at growing its EBIT; that's encouraging. Once we consider all the factors above, together, it seems to us that IS DongSeo's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with IS DongSeo (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading IS DongSeo or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A010780

IS DongSeo

Engages in the construction and construction materials businesses in South Korea.

Fair value with moderate growth potential.

Market Insights

Community Narratives