- South Korea

- /

- Building

- /

- KOSE:A009450

Earnings Not Telling The Story For Kyung Dong Navien Co., Ltd. (KRX:009450) After Shares Rise 29%

Despite an already strong run, Kyung Dong Navien Co., Ltd. (KRX:009450) shares have been powering on, with a gain of 29% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 99% in the last year.

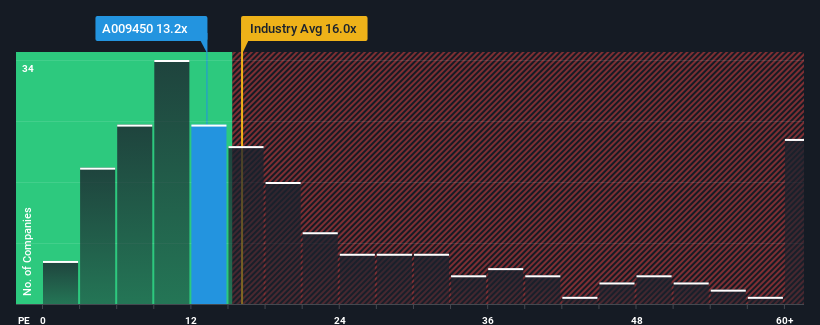

After such a large jump in price, Kyung Dong Navien may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 13.2x, since almost half of all companies in Korea have P/E ratios under 11x and even P/E's lower than 6x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Kyung Dong Navien certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Kyung Dong Navien

Is There Enough Growth For Kyung Dong Navien?

There's an inherent assumption that a company should outperform the market for P/E ratios like Kyung Dong Navien's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 85% last year. As a result, it also grew EPS by 17% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 32% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Kyung Dong Navien's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

Kyung Dong Navien's P/E is getting right up there since its shares have risen strongly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Kyung Dong Navien revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Kyung Dong Navien with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kyung Dong Navien might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A009450

Kyung Dong Navien

Manufactures and sells machinery and heat combustion equipment in South Korea.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives