- South Korea

- /

- Construction

- /

- KOSE:A006360

There's Reason For Concern Over GS Engineering & Construction Corporation's (KRX:006360) Price

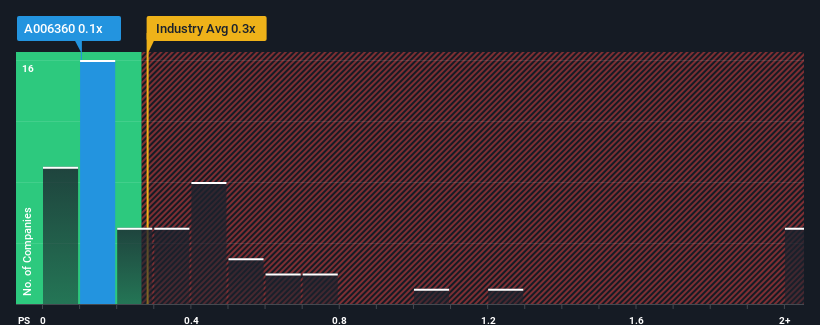

There wouldn't be many who think GS Engineering & Construction Corporation's (KRX:006360) price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S for the Construction industry in Korea is similar at about 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for GS Engineering & Construction

How Has GS Engineering & Construction Performed Recently?

GS Engineering & Construction could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on GS Engineering & Construction will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For GS Engineering & Construction?

The only time you'd be comfortable seeing a P/S like GS Engineering & Construction's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.3%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 34% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth is heading into negative territory, declining 0.6% over the next year. That's not great when the rest of the industry is expected to grow by 2.0%.

In light of this, it's somewhat alarming that GS Engineering & Construction's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From GS Engineering & Construction's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

While GS Engineering & Construction's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

And what about other risks? Every company has them, and we've spotted 2 warning signs for GS Engineering & Construction you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A006360

GS Engineering & Construction

Engages in the civil works and construction, sales of new houses, repairs and maintenance, overseas general construction, and technology consultation activities in South Korea and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives