- South Korea

- /

- Electrical

- /

- KOSE:A003670

Revenues Tell The Story For Posco Future M Co., Ltd. (KRX:003670) As Its Stock Soars 25%

Posco Future M Co., Ltd. (KRX:003670) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 24% in the last twelve months.

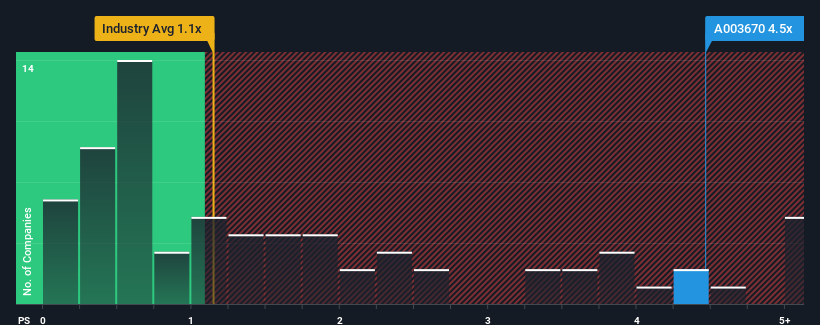

After such a large jump in price, given around half the companies in Korea's Electrical industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Posco Future M as a stock to avoid entirely with its 4.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Posco Future M

How Posco Future M Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, Posco Future M has been doing quite well of late. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Posco Future M's future stacks up against the industry? In that case, our free report is a great place to start.How Is Posco Future M's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Posco Future M's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.8% last year. The latest three year period has also seen an excellent 151% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 33% per annum as estimated by the analysts watching the company. That's shaping up to be materially higher than the 24% per year growth forecast for the broader industry.

With this information, we can see why Posco Future M is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Posco Future M's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Posco Future M shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware Posco Future M is showing 2 warning signs in our investment analysis, and 1 of those is potentially serious.

If these risks are making you reconsider your opinion on Posco Future M, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A003670

Posco Future M

Engages in the refractory, industrial furnaces, and lime business in South Korea and internationally.

Reasonable growth potential very low.

Similar Companies

Market Insights

Community Narratives