- South Korea

- /

- Construction

- /

- KOSE:A001470

Investors Give Sambu Engineering & Construction Co., Ltd (KRX:001470) Shares A 29% Hiding

The Sambu Engineering & Construction Co., Ltd (KRX:001470) share price has softened a substantial 29% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 60% loss during that time.

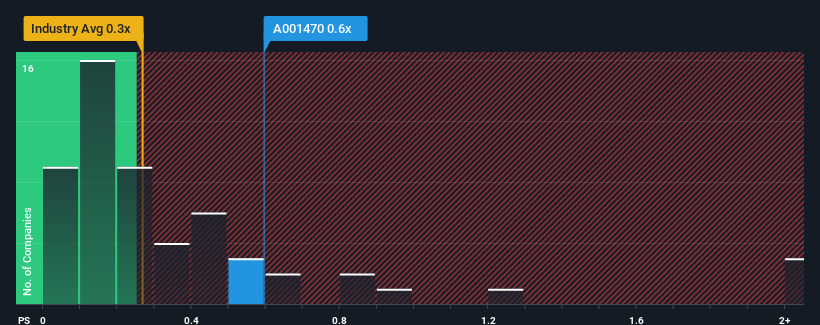

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Sambu Engineering & Construction's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Construction industry in Korea is also close to 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Sambu Engineering & Construction

What Does Sambu Engineering & Construction's P/S Mean For Shareholders?

For instance, Sambu Engineering & Construction's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sambu Engineering & Construction will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Sambu Engineering & Construction?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sambu Engineering & Construction's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 33% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 9.6% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 0.5% shows it's noticeably more attractive.

In light of this, it's curious that Sambu Engineering & Construction's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Sambu Engineering & Construction's P/S?

With its share price dropping off a cliff, the P/S for Sambu Engineering & Construction looks to be in line with the rest of the Construction industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To our surprise, Sambu Engineering & Construction revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Sambu Engineering & Construction you should be aware of, and 2 of them don't sit too well with us.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A001470

Sambu Engineering & Construction

Engages in the construction business in South Korea and internationally.

Good value slight.

Market Insights

Community Narratives