- South Korea

- /

- Construction

- /

- KOSE:A001260

Is Namkwang Engineering & Construction's (KRX:001260) Share Price Gain Of 130% Well Earned?

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. For instance the Namkwang Engineering & Construction Co., Ltd. (KRX:001260) share price is 130% higher than it was three years ago. Most would be happy with that. On top of that, the share price is up 53% in about a quarter. But this could be related to the strong market, which is up 32% in the last three months.

View our latest analysis for Namkwang Engineering & Construction

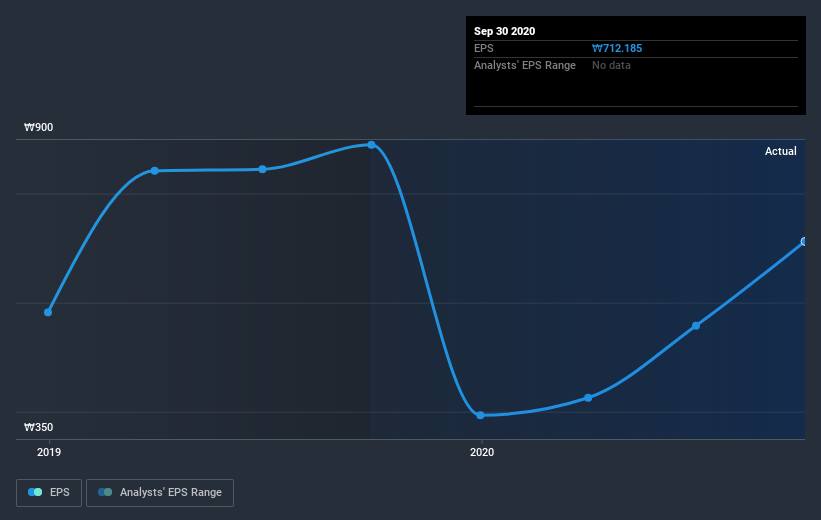

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Namkwang Engineering & Construction became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Namkwang Engineering & Construction's earnings, revenue and cash flow.

A Different Perspective

Namkwang Engineering & Construction provided a TSR of 45% over the year. That's fairly close to the broader market return. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 6%, which was endured over half a decade. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Namkwang Engineering & Construction , and understanding them should be part of your investment process.

We will like Namkwang Engineering & Construction better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Namkwang Engineering & Construction or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Namkwang Engineering & Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A001260

Namkwang Engineering & Construction

Namkwang Engineering & Construction Co., Ltd.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success