- South Korea

- /

- Industrials

- /

- KOSE:A000150

Investors Still Aren't Entirely Convinced By Doosan Corporation's (KRX:000150) Revenues Despite 59% Price Jump

The Doosan Corporation (KRX:000150) share price has done very well over the last month, posting an excellent gain of 59%. This latest share price bounce rounds out a remarkable 317% gain over the last twelve months.

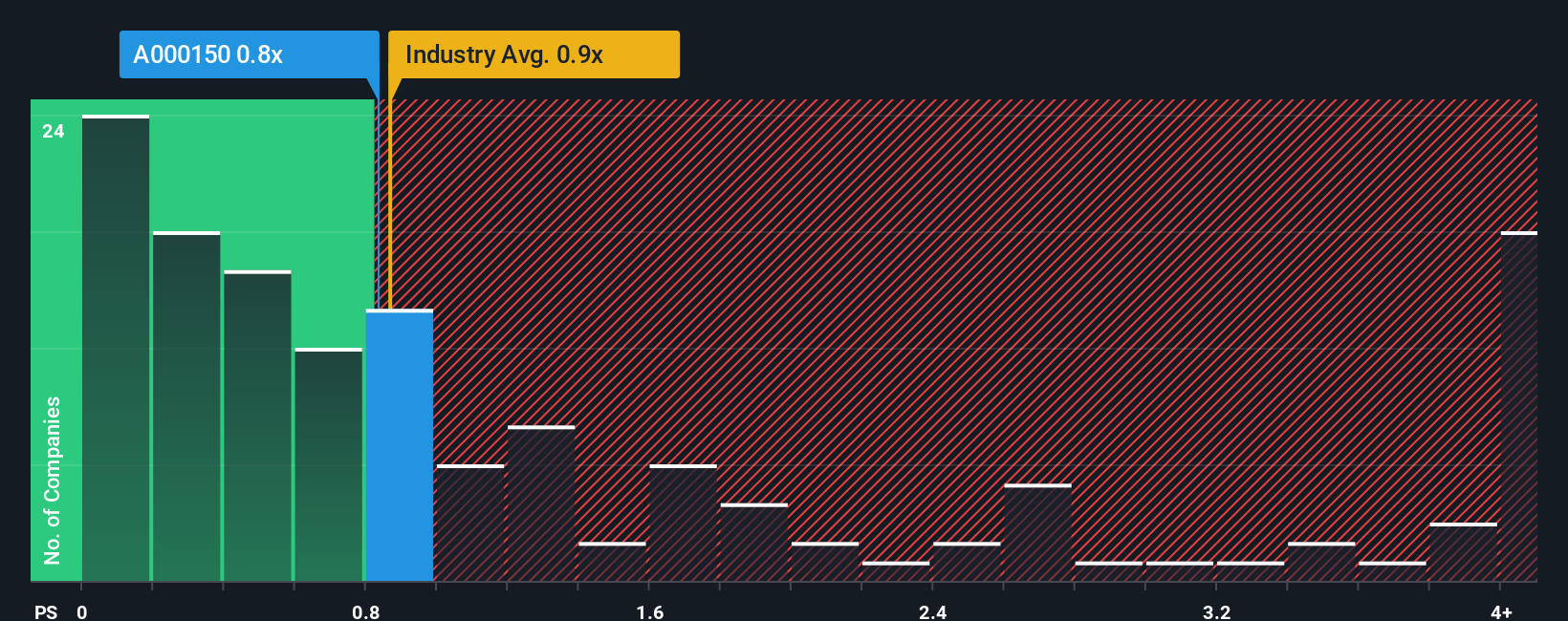

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Doosan's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Industrials industry in Korea is also close to 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Doosan

What Does Doosan's Recent Performance Look Like?

Doosan hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Doosan will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Doosan's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow revenue by 28% in total over the last three years. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 9.4% during the coming year according to the seven analysts following the company. That would be an excellent outcome when the industry is expected to decline by 16%.

With this in mind, we find it intriguing that Doosan's P/S trades in-line with its industry peers. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Key Takeaway

Doosan's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We note that even though Doosan trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Doosan you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A000150

Doosan

Engages in the power generation facilities, industrial facilities, construction machinery, engines, and construction businesses in Korea, the United States, Asia, the Middle East, Europe, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives