- China

- /

- Electronic Equipment and Components

- /

- SZSE:003019

Undiscovered Gems on None Exchange for February 2025

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and shifting trade policies, small-cap stocks have been underperforming compared to their larger counterparts, with the Russell 2000 trailing behind major indices like the S&P 500. Despite this, the broader market sentiment remains cautiously optimistic as investors seek opportunities in overlooked sectors that could benefit from current economic conditions. Identifying a good stock often involves looking for companies with strong fundamentals and growth potential that may not yet be fully recognized by the market, especially in times of economic uncertainty or transition.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Jordanian Duty Free Shops | NA | 10.61% | -7.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

PIE (KOSDAQ:A452450)

Simply Wall St Value Rating: ★★★★☆☆

Overview: PIE Co., LTD. is a South Korean company specializing in the manufacturing and sale of industrial inspection equipment, with a market cap of ₩404.83 billion.

Operations: The company generates revenue primarily from the sale of industrial inspection equipment.

PIE Co., a burgeoning player in its sector, recently completed an IPO raising KRW 18 billion, offering over 3.6 million shares at KRW 5,000 each with a slight discount. This move reflects strong market interest and provides fresh capital for growth initiatives. The company boasts impressive earnings growth of 2163% in the past year, significantly outpacing the industry’s -0.3% performance. Despite its high level of non-cash earnings and illiquid shares, PIE's debt is well-covered by EBIT at 26.6 times interest payments, suggesting financial stability amidst rapid expansion efforts.

- Dive into the specifics of PIE here with our thorough health report.

Gain insights into PIE's past trends and performance with our Past report.

Shaanxi Sirui Advanced Materials (SHSE:688102)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shaanxi Sirui Advanced Materials Co., Ltd. operates in the advanced materials sector and has a market capitalization of CN¥7.09 billion.

Operations: The company generates revenue primarily from its advanced materials segment. It has experienced fluctuations in its gross profit margin, reaching 32% in the latest period.

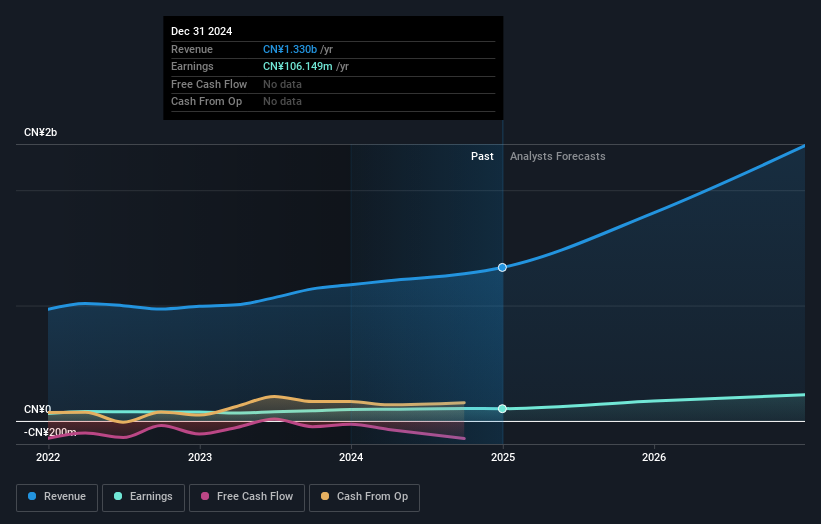

Shaanxi Sirui Advanced Materials, a promising player in the materials sector, reported sales of CNY 1.33 billion for 2024, up from CNY 1.18 billion the previous year. Net income also improved to CNY 106.15 million from CNY 81.19 million, with basic earnings per share rising to CNY 0.1616 from CNY 0.1351. Despite a high net debt to equity ratio of 49.6%, interest payments are well-covered at a robust EBIT coverage of 10.5 times, suggesting financial stability amidst growth prospects forecasted at an impressive annual rate of nearly 36%.

TES Touch Embedded Solutions (Xiamen) (SZSE:003019)

Simply Wall St Value Rating: ★★★★★☆

Overview: TES Touch Embedded Solutions (Xiamen) Co., Ltd. is a JDM/ODM company specializing in the research, development, design, manufacture, and sale of touchscreen products both in Taiwan and internationally with a market cap of CN¥4.50 billion.

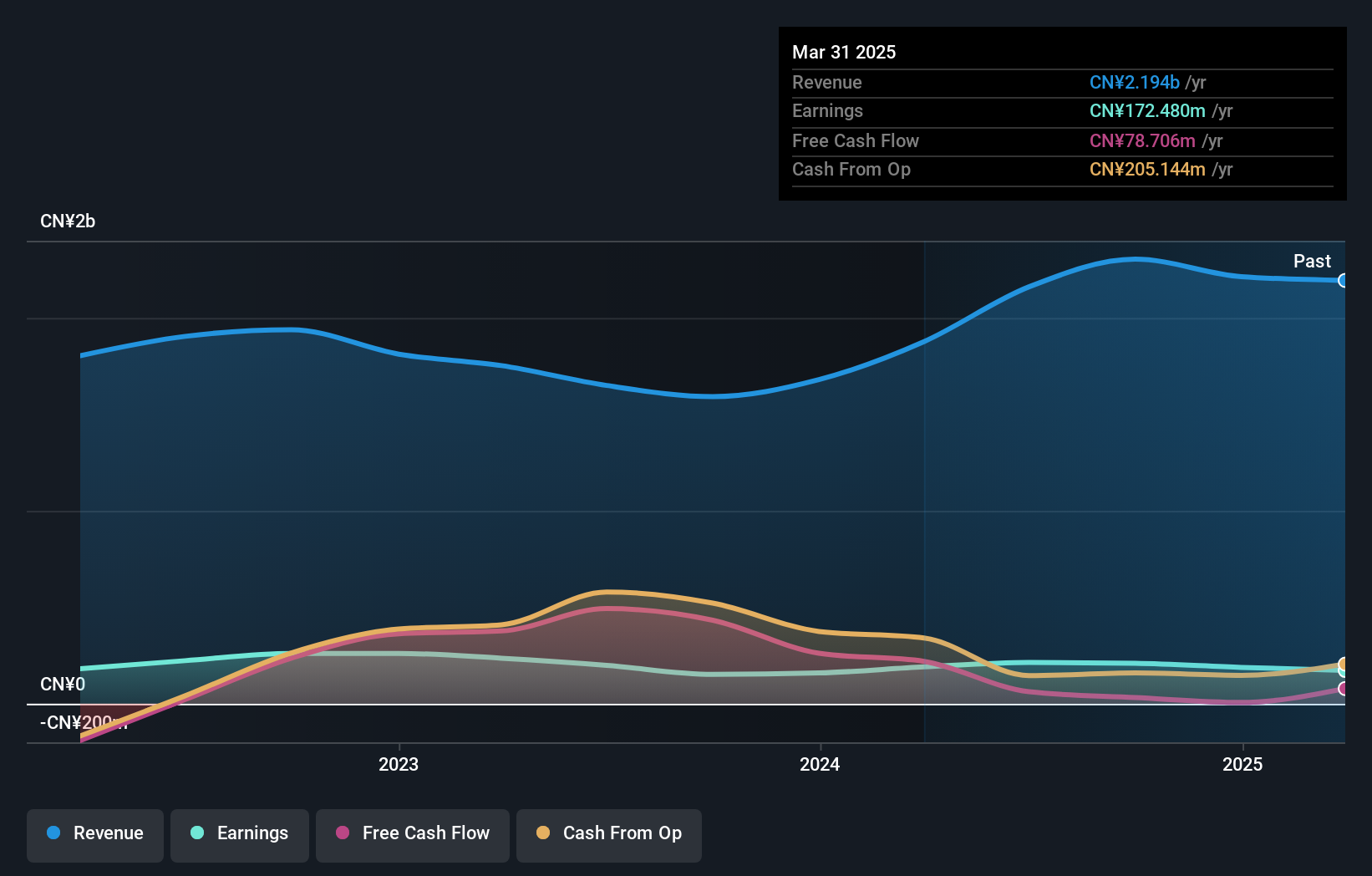

Operations: TES Touch Embedded Solutions (Xiamen) generates revenue primarily from the manufacture and sale of touchscreen products, with a significant portion amounting to CN¥1.96 billion coming from the Computer, Communications, and Other Electronic Equipment Manufacturing segment.

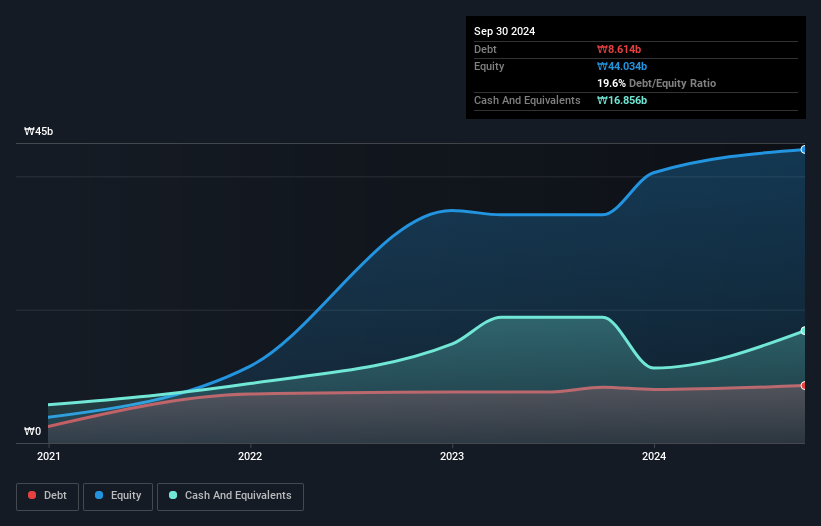

TES Touch Embedded Solutions, a dynamic player in the electronics sector, has shown impressive financial performance with earnings growth of 50% over the past year, outpacing the industry average of 1.9%. The company boasts high-quality earnings and a favorable price-to-earnings ratio of 19.7x compared to the CN market's 36.6x, indicating potential undervaluation. However, its debt-to-equity ratio has risen from 9.4 to 24.8 over five years, which could be a point for investors to monitor closely. A recent shareholders meeting suggests active engagement with stakeholders and possible strategic shifts ahead for this promising entity in Xiamen.

Taking Advantage

- Get an in-depth perspective on all 4716 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TES Touch Embedded Solutions (Xiamen) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003019

TES Touch Embedded Solutions (Xiamen)

A JDM/ODM company, engages in the research, development, design, manufacture, and sale of touchscreen products in Taiwan and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives