- South Korea

- /

- Machinery

- /

- KOSDAQ:A382480

G.I. Tech's (KOSDAQ:382480) Soft Earnings Are Actually Better Than They Appear

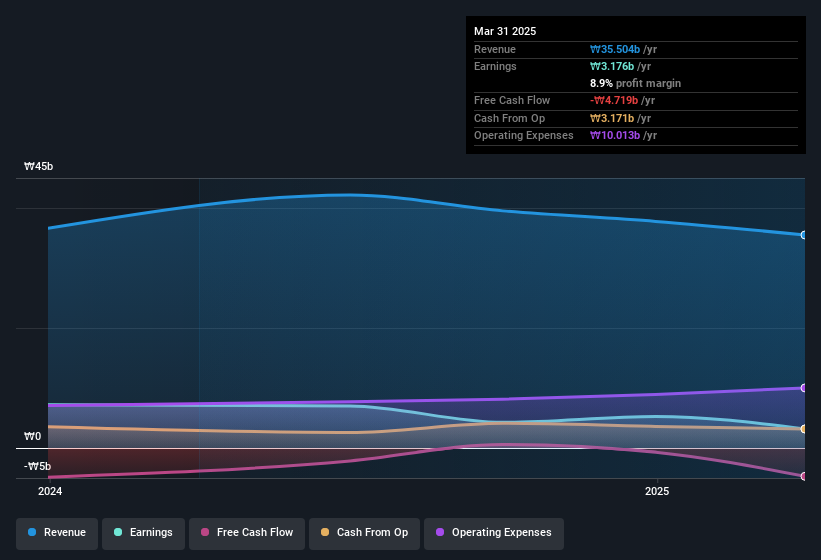

The most recent earnings report from G.I. Tech Co., Ltd. (KOSDAQ:382480) was disappointing for shareholders. While the headline numbers were soft, we believe that investors might be missing some encouraging factors.

Our free stock report includes 4 warning signs investors should be aware of before investing in G.I. Tech. Read for free now.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, G.I. Tech issued 15% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out G.I. Tech's historical EPS growth by clicking on this link.

A Look At The Impact Of G.I. Tech's Dilution On Its Earnings Per Share (EPS)

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. And even focusing only on the last twelve months, we see profit is down 55%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 46% in the same period. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If G.I. Tech's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of G.I. Tech.

The Impact Of Unusual Items On Profit

Alongside that dilution, it's also important to note that G.I. Tech's profit suffered from unusual items, which reduced profit by ₩412m in the last twelve months. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. Assuming those unusual expenses don't come up again, we'd therefore expect G.I. Tech to produce a higher profit next year, all else being equal.

Our Take On G.I. Tech's Profit Performance

G.I. Tech suffered from unusual items which depressed its profit in its last report; if that is not repeated then profit should be higher, all else being equal. But on the other hand, the company issued more shares, so without buying more shares each shareholder will end up with a smaller part of the profit. Based on these factors, it's hard to tell if G.I. Tech's profits are a reasonable reflection of its underlying profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For example, G.I. Tech has 4 warning signs (and 1 which is a bit unpleasant) we think you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A382480

G.I. Tech

Engages in the manufacture of special-purpose machinery products in South Korea.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.