- South Korea

- /

- Construction

- /

- KOSDAQ:A319400

HYUNDAI MOVEX Co., Ltd. (KOSDAQ:319400) Shares May Have Slumped 31% But Getting In Cheap Is Still Unlikely

HYUNDAI MOVEX Co., Ltd. (KOSDAQ:319400) shares have retraced a considerable 31% in the last month, reversing a fair amount of their solid recent performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 206% in the last twelve months.

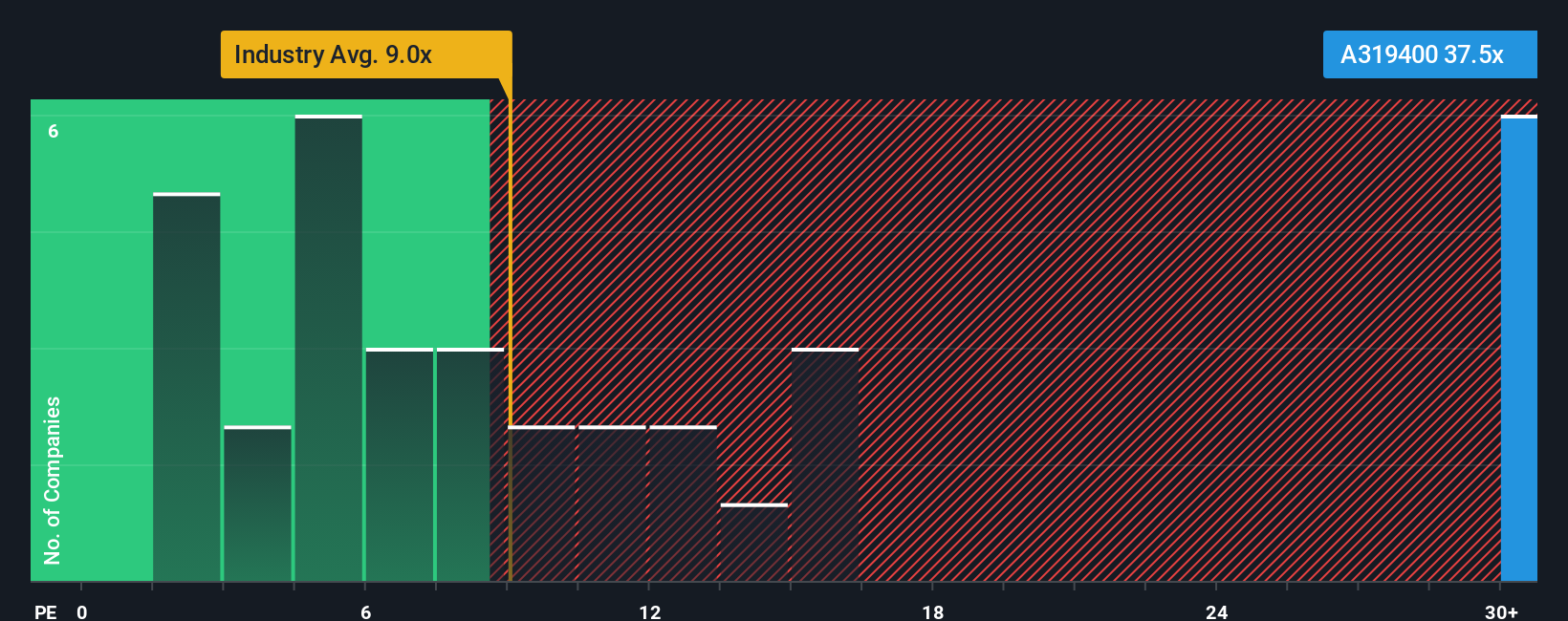

Although its price has dipped substantially, HYUNDAI MOVEX may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 37.5x, since almost half of all companies in Korea have P/E ratios under 14x and even P/E's lower than 7x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With its earnings growth in positive territory compared to the declining earnings of most other companies, HYUNDAI MOVEX has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for HYUNDAI MOVEX

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as HYUNDAI MOVEX's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 69% gain to the company's bottom line. The latest three year period has also seen an excellent 118% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 13% per annum during the coming three years according to the two analysts following the company. Meanwhile, the rest of the market is forecast to expand by 19% each year, which is noticeably more attractive.

With this information, we find it concerning that HYUNDAI MOVEX is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From HYUNDAI MOVEX's P/E?

Even after such a strong price drop, HYUNDAI MOVEX's P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that HYUNDAI MOVEX currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for HYUNDAI MOVEX you should be aware of, and 1 of them is a bit unpleasant.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if HYUNDAI MOVEX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A319400

HYUNDAI MOVEX

Operates in the information technology (IT) and logistics system businesses in South Korea and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives