- South Korea

- /

- Machinery

- /

- KOSDAQ:A299030

More Unpleasant Surprises Could Be In Store For Hana Technology Co., Ltd.'s (KOSDAQ:299030) Shares After Tumbling 31%

The Hana Technology Co., Ltd. (KOSDAQ:299030) share price has fared very poorly over the last month, falling by a substantial 31%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 57% loss during that time.

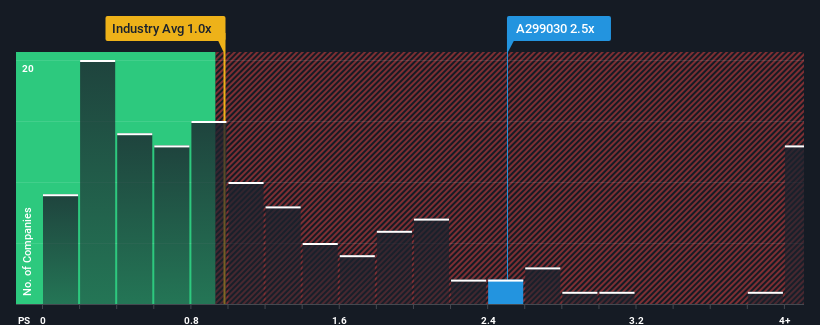

Even after such a large drop in price, given close to half the companies operating in Korea's Machinery industry have price-to-sales ratios (or "P/S") below 1x, you may still consider Hana Technology as a stock to potentially avoid with its 2.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Hana Technology

How Has Hana Technology Performed Recently?

With revenue growth that's inferior to most other companies of late, Hana Technology has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hana Technology.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Hana Technology's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. However, a few strong years before that means that it was still able to grow revenue by an impressive 31% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Turning to the outlook, the next year should generate growth of 29% as estimated by the only analyst watching the company. With the industry predicted to deliver 33% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Hana Technology is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Hana Technology's P/S?

There's still some elevation in Hana Technology's P/S, even if the same can't be said for its share price recently. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Hana Technology currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you settle on your opinion, we've discovered 2 warning signs for Hana Technology that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hana Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A299030

Hana Technology

Engages in the development of precision automation solutions in the industrial field in South Korea.

High growth potential with imperfect balance sheet.

Market Insights

Community Narratives