- South Korea

- /

- Machinery

- /

- KOSDAQ:A299030

Hana Technology Co., Ltd. (KOSDAQ:299030) Stocks Shoot Up 26% But Its P/S Still Looks Reasonable

Hana Technology Co., Ltd. (KOSDAQ:299030) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. But the last month did very little to improve the 55% share price decline over the last year.

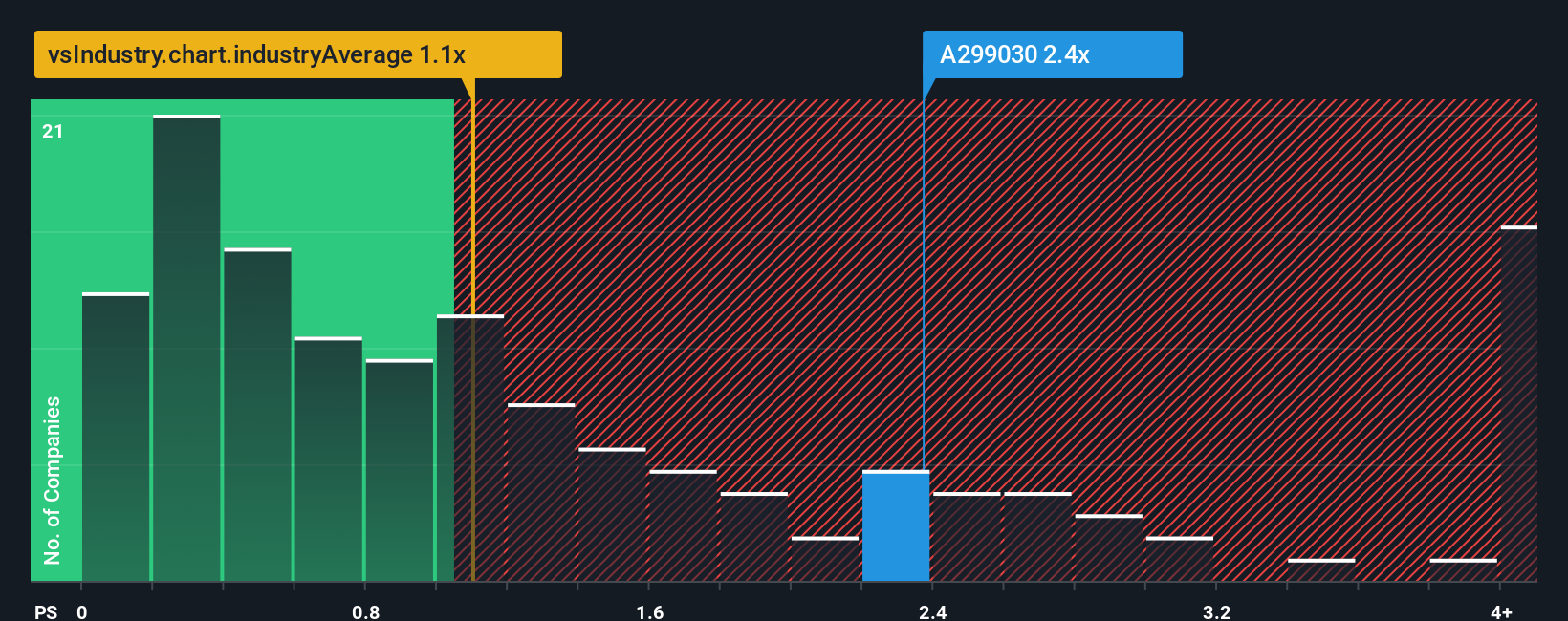

Since its price has surged higher, when almost half of the companies in Korea's Machinery industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Hana Technology as a stock probably not worth researching with its 2.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Hana Technology

What Does Hana Technology's P/S Mean For Shareholders?

Hana Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Hana Technology will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Hana Technology's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 38%. As a result, revenue from three years ago have also fallen 37% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 93% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 19%, which is noticeably less attractive.

In light of this, it's understandable that Hana Technology's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The large bounce in Hana Technology's shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Hana Technology shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Hana Technology that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hana Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A299030

Hana Technology

Engages in the development of precision automation solutions in the industrial field in South Korea.

High growth potential with imperfect balance sheet.

Market Insights

Community Narratives