- South Korea

- /

- Machinery

- /

- KOSDAQ:A290670

Daebo Magnetic Co.,Ltd.'s (KOSDAQ:290670) Stock is Soaring But Financials Seem Inconsistent: Will The Uptrend Continue?

Daebo MagneticLtd (KOSDAQ:290670) has had a great run on the share market with its stock up by a significant 13% over the last month. However, we wonder if the company's inconsistent financials would have any adverse impact on the current share price momentum. Particularly, we will be paying attention to Daebo MagneticLtd's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for Daebo MagneticLtd

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Daebo MagneticLtd is:

2.9% = ₩1.0b ÷ ₩36b (Based on the trailing twelve months to June 2020).

The 'return' refers to a company's earnings over the last year. That means that for every ₩1 worth of shareholders' equity, the company generated ₩0.03 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Daebo MagneticLtd's Earnings Growth And 2.9% ROE

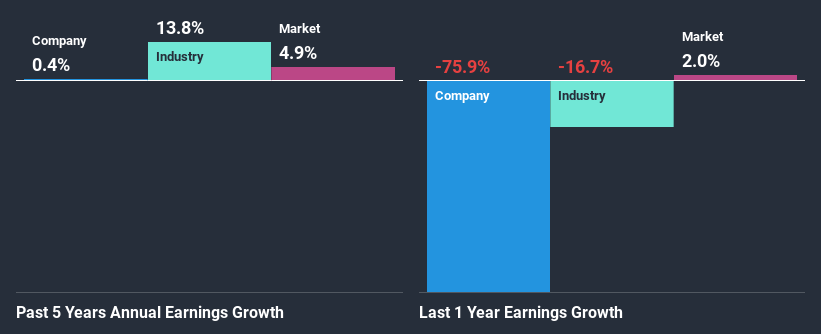

As you can see, Daebo MagneticLtd's ROE looks pretty weak. Even when compared to the industry average of 5.0%, the ROE figure is pretty disappointing. Therefore, Daebo MagneticLtd's flat earnings over the past five years can possibly be explained by the low ROE amongst other factors.

As a next step, we compared Daebo MagneticLtd's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 14% in the same period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Daebo MagneticLtd's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Daebo MagneticLtd Using Its Retained Earnings Effectively?

Summary

In total, we're a bit ambivalent about Daebo MagneticLtd's performance. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Daebo MagneticLtd's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you’re looking to trade Daebo MagneticLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A290670

Daebo MagneticLtd

Manufactures and sells electro magnetic filters that are used for secondary battery material process and cell process.

Excellent balance sheet low.

Market Insights

Community Narratives