- South Korea

- /

- Aerospace & Defense

- /

- KOSDAQ:A274090

Introducing Kencoa Aerospace (KOSDAQ:274090), A Stock That Climbed 56% In The Last Year

Kencoa Aerospace Corporation (KOSDAQ:274090) shareholders might be concerned after seeing the share price drop 13% in the last week. But that fact in itself shouldn't obscure what are quite decent returns over the last year. Indeed the stock is up 56% over twelve months, compared to a market return of about 55%.

View our latest analysis for Kencoa Aerospace

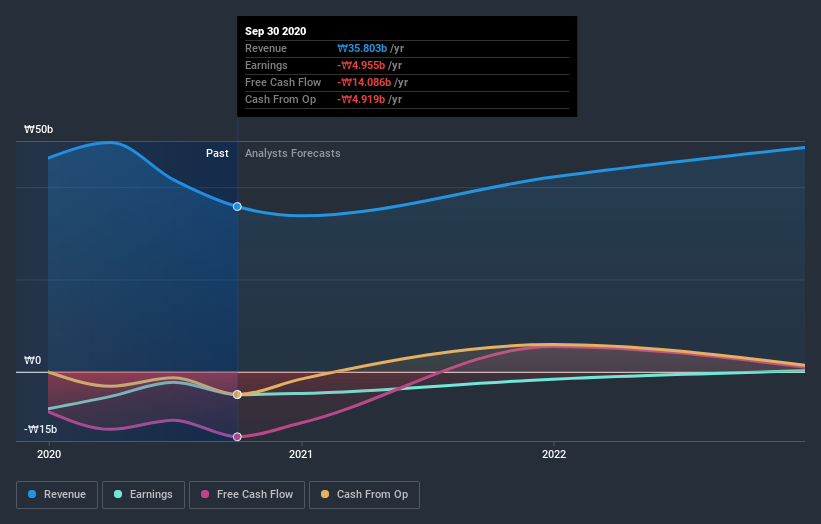

Given that Kencoa Aerospace didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Kencoa Aerospace's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Kencoa Aerospace shareholders have gained 56% over twelve months, which isn't far from the market return of 55%. A substantial portion of that gain has come in the last three months, with the stock up 89% in that time. This suggests the share price maintains some momentum, and investors are taking a more positive view of the stock. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Kencoa Aerospace has 3 warning signs we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Kencoa Aerospace or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kencoa Aerospace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A274090

Kencoa Aerospace

Provides aerospace products for OEM and top-tier customers in South Korea and the United States.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives