- South Korea

- /

- Electrical

- /

- KOSDAQ:A140670

RS AutomationLtd (KOSDAQ:140670) rallies 15% this week, taking five-year gains to 79%

The simplest way to invest in stocks is to buy exchange traded funds. But the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, the RS Automation Co.,Ltd. (KOSDAQ:140670) share price is up 67% in the last five years, slightly above the market return. We're also happy to report the stock is up a healthy 41% in the last year.

Since the stock has added ₩17b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

RS AutomationLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

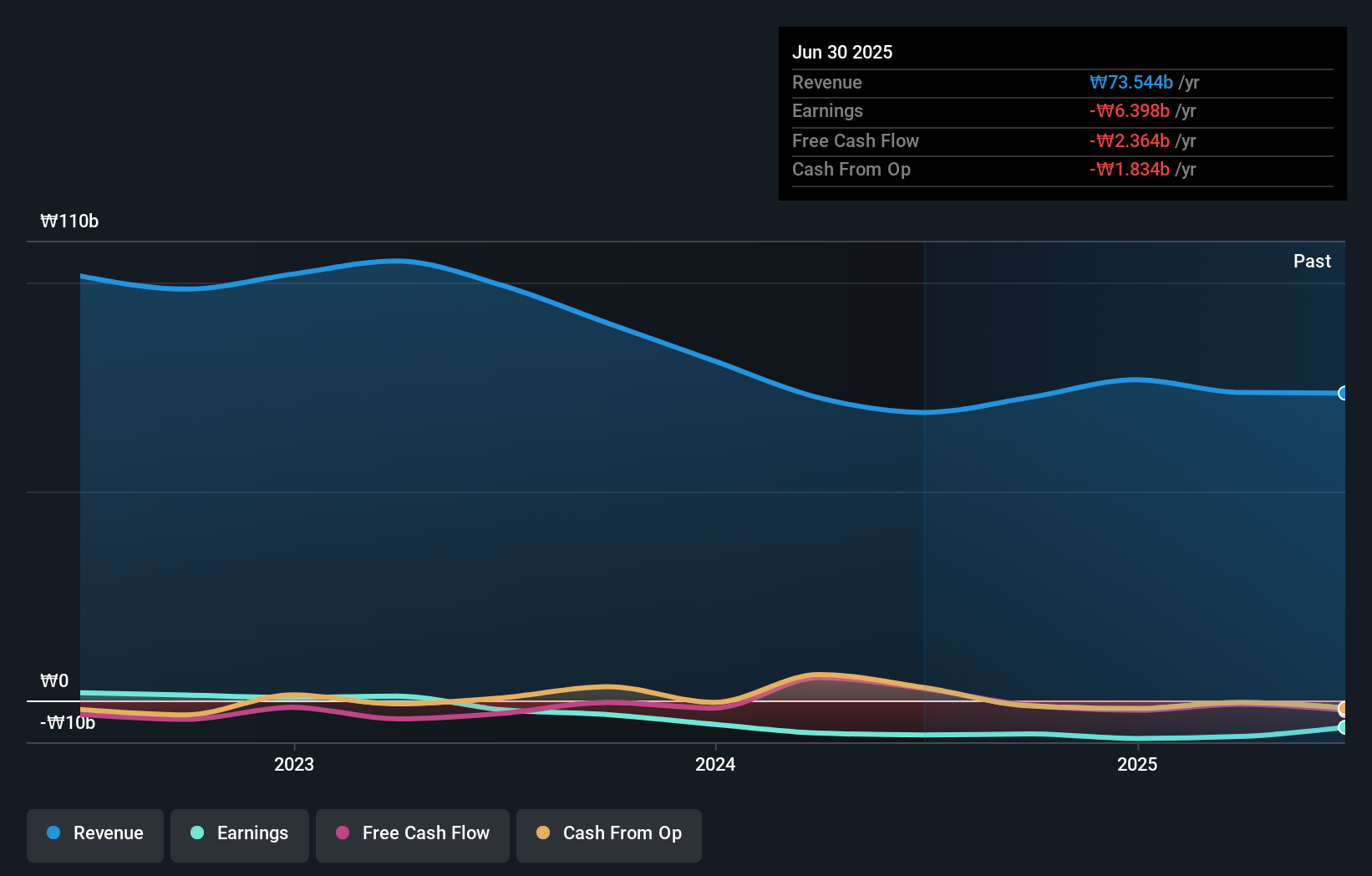

In the last 5 years RS AutomationLtd saw its revenue shrink by 7.6% per year. Even though revenue hasn't increased, the stock actually gained 11%, per year, during the same period. To us that suggests that there probably isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between RS AutomationLtd's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. RS AutomationLtd hasn't been paying dividends, but its TSR of 79% exceeds its share price return of 67%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

RS AutomationLtd shareholders are up 51% for the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 12% over half a decade It is possible that returns will improve along with the business fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with RS AutomationLtd (including 2 which are a bit concerning) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A140670

RS AutomationLtd

Designs, develops, manufactures, sells, and services automation equipment and systems in South Korea and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives