- South Korea

- /

- Electrical

- /

- KOSDAQ:A125210

These 4 Measures Indicate That AmogreentechLtd (KOSDAQ:125210) Is Using Debt Extensively

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Amogreentech Co.,Ltd (KOSDAQ:125210) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for AmogreentechLtd

What Is AmogreentechLtd's Net Debt?

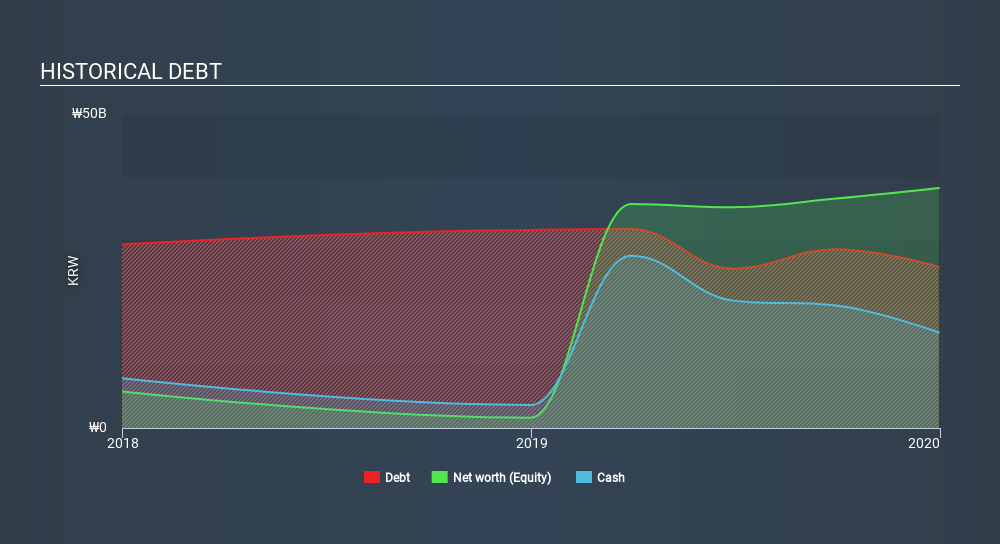

You can click the graphic below for the historical numbers, but it shows that AmogreentechLtd had ₩25.7b of debt in December 2019, down from ₩31.5b, one year before. However, it does have ₩15.2b in cash offsetting this, leading to net debt of about ₩10.5b.

A Look At AmogreentechLtd's Liabilities

According to the last reported balance sheet, AmogreentechLtd had liabilities of ₩37.3b due within 12 months, and liabilities of ₩13.3b due beyond 12 months. Offsetting this, it had ₩15.2b in cash and ₩16.8b in receivables that were due within 12 months. So it has liabilities totalling ₩18.6b more than its cash and near-term receivables, combined.

Since publicly traded AmogreentechLtd shares are worth a total of ₩248.3b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

AmogreentechLtd's net debt is sitting at a very reasonable 1.8 times its EBITDA, while its EBIT covered its interest expense just 2.7 times last year. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. Notably, AmogreentechLtd made a loss at the EBIT level, last year, but improved that to positive EBIT of ₩2.6b in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is AmogreentechLtd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. During the last year, AmogreentechLtd burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

AmogreentechLtd's struggle to convert EBIT to free cash flow had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. For example, its level of total liabilities is relatively strong. When we consider all the factors discussed, it seems to us that AmogreentechLtd is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for AmogreentechLtd (2 are a bit concerning) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About KOSDAQ:A125210

AmogreentechLtd

Provides various products for IT, energy, nano, environment, and bio industries in South Korea and internationally.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion