- South Korea

- /

- Machinery

- /

- KOSDAQ:A104460

Further weakness as DYPNFLtd (KOSDAQ:104460) drops 16% this week, taking three-year losses to 57%

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But long term DYPNF Co.,Ltd (KOSDAQ:104460) shareholders have had a particularly rough ride in the last three year. Unfortunately, they have held through a 57% decline in the share price in that time. The last week also saw the share price slip down another 16%.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

DYPNFLtd became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

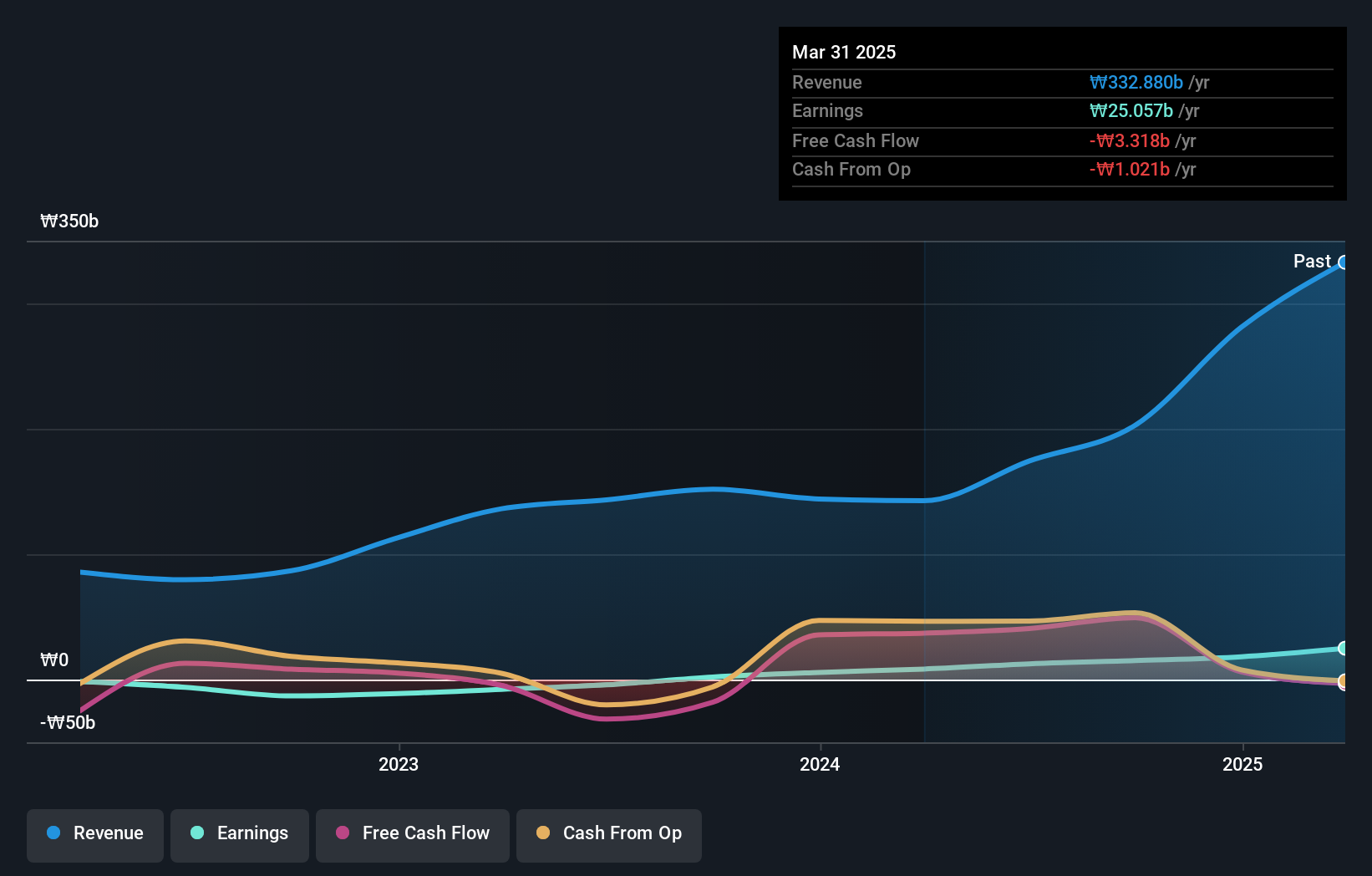

We note that, in three years, revenue has actually grown at a 43% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching DYPNFLtd more closely, as sometimes stocks fall unfairly. This could present an opportunity.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that DYPNFLtd shareholders have received a total shareholder return of 30% over the last year. That's better than the annualised return of 1.8% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand DYPNFLtd better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with DYPNFLtd .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A104460

DYPNFLtd

Manufactures and sells powder transport equipment in South Korea, the United States, the Middle East, Southeast Asia, Europe, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives