- South Korea

- /

- Construction

- /

- KOSDAQ:A100130

Should Dongkuk Structures & Construction Company Limited (KOSDAQ:100130) Be Part Of Your Dividend Portfolio?

Dividend paying stocks like Dongkuk Structures & Construction Company Limited (KOSDAQ:100130) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

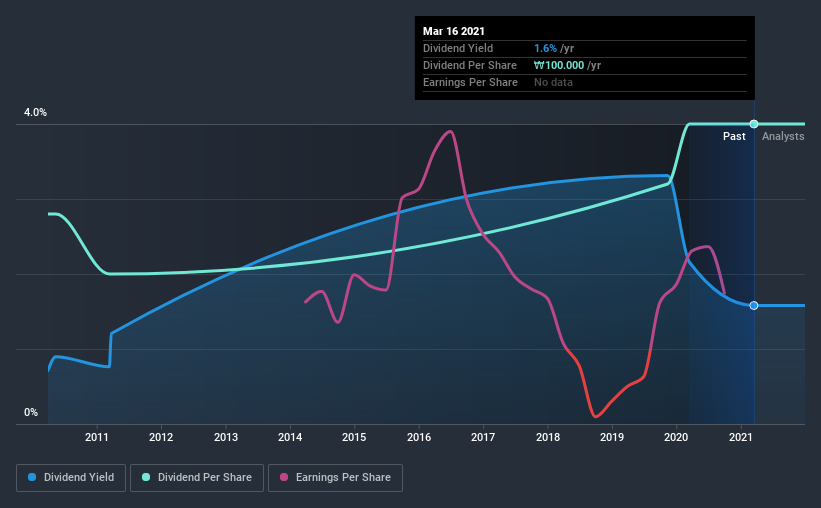

While Dongkuk Structures & Construction's 1.6% dividend yield is not the highest, we think its lengthy payment history is quite interesting. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Explore this interactive chart for our latest analysis on Dongkuk Structures & Construction!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Dongkuk Structures & Construction paid out 67% of its profit as dividends, over the trailing twelve month period. A payout ratio above 50% generally implies a business is reaching maturity, although it is still possible to reinvest in the business or increase the dividend over time.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Dongkuk Structures & Construction's cash payout ratio last year was 6.4%, which is quite low and suggests that the dividend was thoroughly covered by cash flow. It's positive to see that Dongkuk Structures & Construction's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

While the above analysis focuses on dividends relative to a company's earnings, we do note Dongkuk Structures & Construction's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on Dongkuk Structures & Construction's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of Dongkuk Structures & Construction's dividend payments. The dividend has been cut on at least one occasion historically. During the past 10-year period, the first annual payment was ₩70.0 in 2011, compared to ₩100 last year. This works out to be a compound annual growth rate (CAGR) of approximately 3.6% a year over that time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

It's good to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth, anyway. We're not that enthused by this.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? Dongkuk Structures & Construction's earnings per share have shrunk at 18% a year over the past five years. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Dongkuk Structures & Construction's earnings per share, which support the dividend, have been anything but stable.

Conclusion

To summarise, shareholders should always check that Dongkuk Structures & Construction's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. First, we think Dongkuk Structures & Construction has an acceptable payout ratio and its dividend is well covered by cashflow. Earnings per share are down, and Dongkuk Structures & Construction's dividend has been cut at least once in the past, which is disappointing. In sum, we find it hard to get excited about Dongkuk Structures & Construction from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 2 warning signs for Dongkuk Structures & Construction that you should be aware of before investing.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you decide to trade Dongkuk Structures & Construction, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A100130

Dongkuk Structures & Construction

Engages in the manufacture and sale of wind towers in South Korea and internationally.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026