Stock Analysis

- South Korea

- /

- Building

- /

- KOSE:A009450

Exploring Three Undiscovered Gems In South Korea

Reviewed by Simply Wall St

The South Korean market has experienced a 4.0% decline over the last week, maintaining a generally flat performance throughout the past year. However, with earnings expected to grow by 29% annually, identifying stocks with strong fundamentals and growth potential could be particularly rewarding in this environment.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CYMECHS | 10.99% | 11.45% | 3.52% | ★★★★★★ |

| Samyang | 47.03% | 6.61% | 22.07% | ★★★★★★ |

| Korea Cast Iron Pipe Ind | NA | 2.58% | 14.14% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 0.40% | 27.17% | ★★★★★★ |

| Miwon Chemicals | 0.16% | 12.04% | 14.03% | ★★★★★★ |

| NOROO PAINT & COATINGS | 17.16% | 5.11% | 6.31% | ★★★★★★ |

| ASIA Holdings | 34.13% | 8.28% | 15.67% | ★★★★★★ |

| BIO-FD&CLtd | 2.01% | 8.27% | 22.82% | ★★★★★★ |

| Ubiquoss Holdings | 2.69% | 9.93% | 14.22% | ★★★★★☆ |

| EASY BIOInc | 188.46% | 15.71% | 55.75% | ★★★★☆☆ |

We'll examine a selection from our screener results.

VT (KOSDAQ:A018290)

Simply Wall St Value Rating: ★★★★★★

Overview: VT Co., Ltd. is a diversified company engaged in the production and global export of laminating machines and films, also operating in the cosmetics and entertainment sectors, with a market capitalization of ₩1.32 trillion.

Operations: VT operates primarily in the cosmetics, laminating, and entertainment sectors, generating significant revenue from these segments with cosmetics being the dominant source. The company's business model reflects a substantial gross profit margin of 48.76% as of the latest reporting period in 2024, indicating a strong pricing power or cost management strategy relative to its production costs.

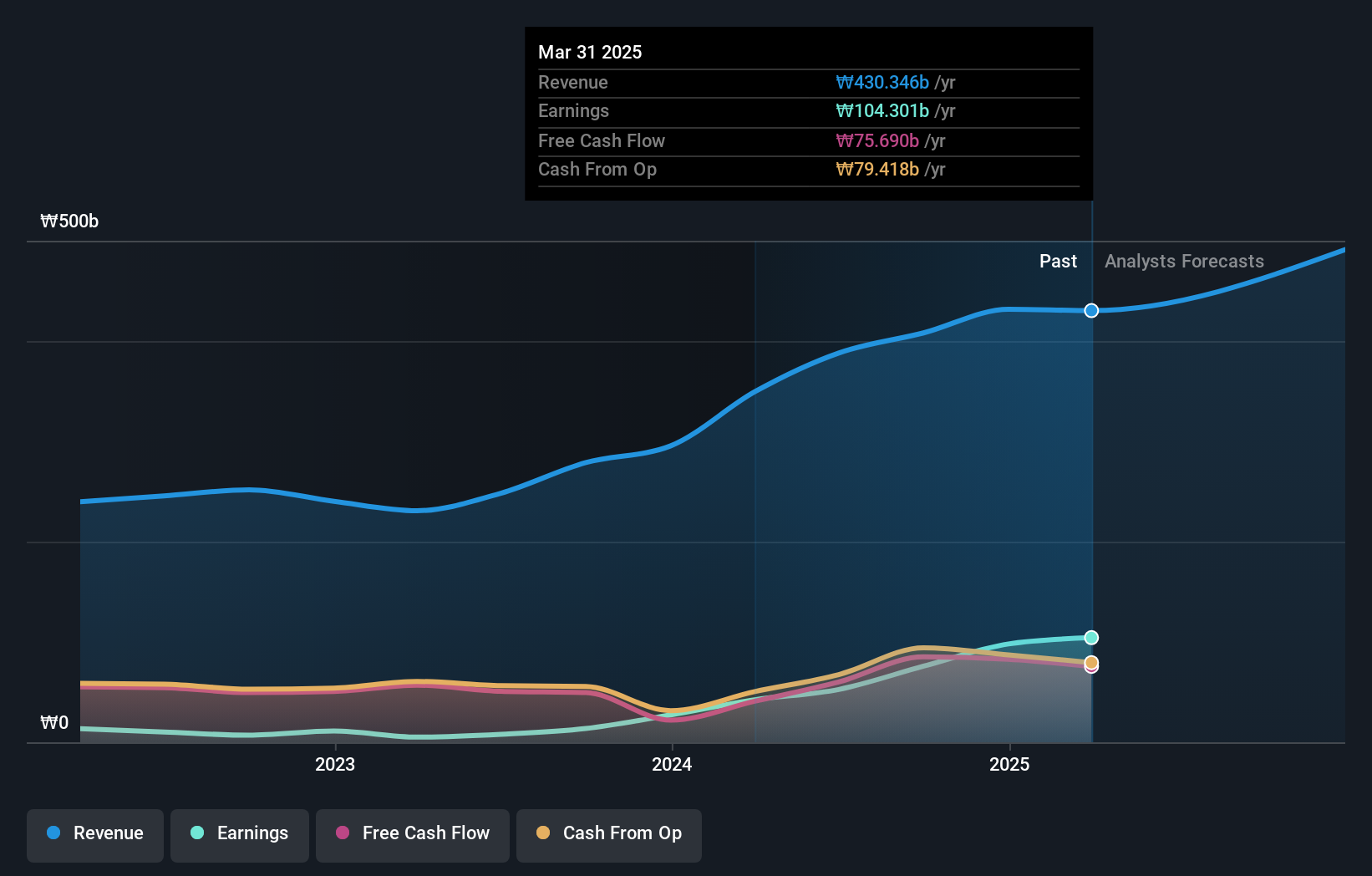

VT, a lesser-known entity in South Korea's Personal Products industry, has shown remarkable financial performance. With earnings growth of 727% last year, far surpassing the industry average of 37%, VT demonstrates robust potential. The company's debt-to-equity ratio improved significantly from 43% to 25% over five years, reflecting strong financial health. Additionally, its interest payments are well-covered by EBIT at a rate of 319 times. These factors position VT as an intriguing prospect for those exploring new opportunities in the market.

- Get an in-depth perspective on VT's performance by reading our health report here.

Examine VT's past performance report to understand how it has performed in the past.

Satrec Initiative (KOSDAQ:A099320)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Satrec Initiative Co., Ltd., together with its subsidiaries, offers solutions for earth observation missions globally and has a market capitalization of approximately ₩579.32 billion.

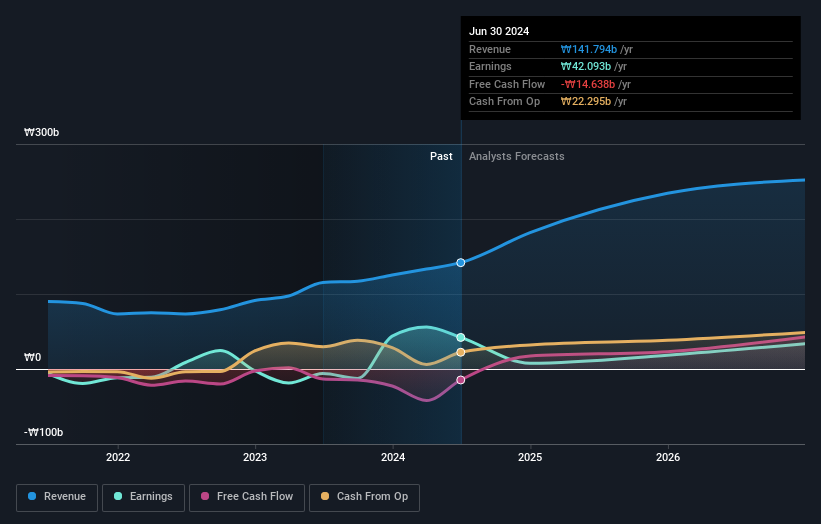

Operations: The company generates revenue primarily through the sale of goods and services, evidenced by a consistent increase in gross profits over several periods, reflecting an upward trend in operational efficiency. Notably, the net income has shown significant fluctuations, with notable peaks and troughs that suggest varying profitability across different fiscal quarters. This variability in net income is accompanied by changes in operating expenses and non-operating activities, impacting overall financial performance.

Satrec Initiative, a lesser-known entity in the Aerospace & Defense sector, recently demonstrated significant financial improvements. For Q1 2024, sales doubled to KRW 820.54 million from KRW 404.95 million year-over-year, while net losses substantially decreased to KRW 2,431.93 million from KRW 14,667.9 million. Despite a challenging past with shareholder dilution and a volatile share price, Satrec's P/E ratio stands attractively at 10.3x—below South Korea's market average of 12.2x—indicating potential undervaluation amidst its turnaround and growth trajectory of expected revenue increases by approximately 24% annually.

Kyung Dong Navien (KOSE:A009450)

Simply Wall St Value Rating: ★★★★★★

Overview: Kyung Dong Navien Co., Ltd. is a South Korean company specializing in the manufacture and sale of machinery and heating combustion equipment, with a market capitalization of approximately ₩893.19 billion.

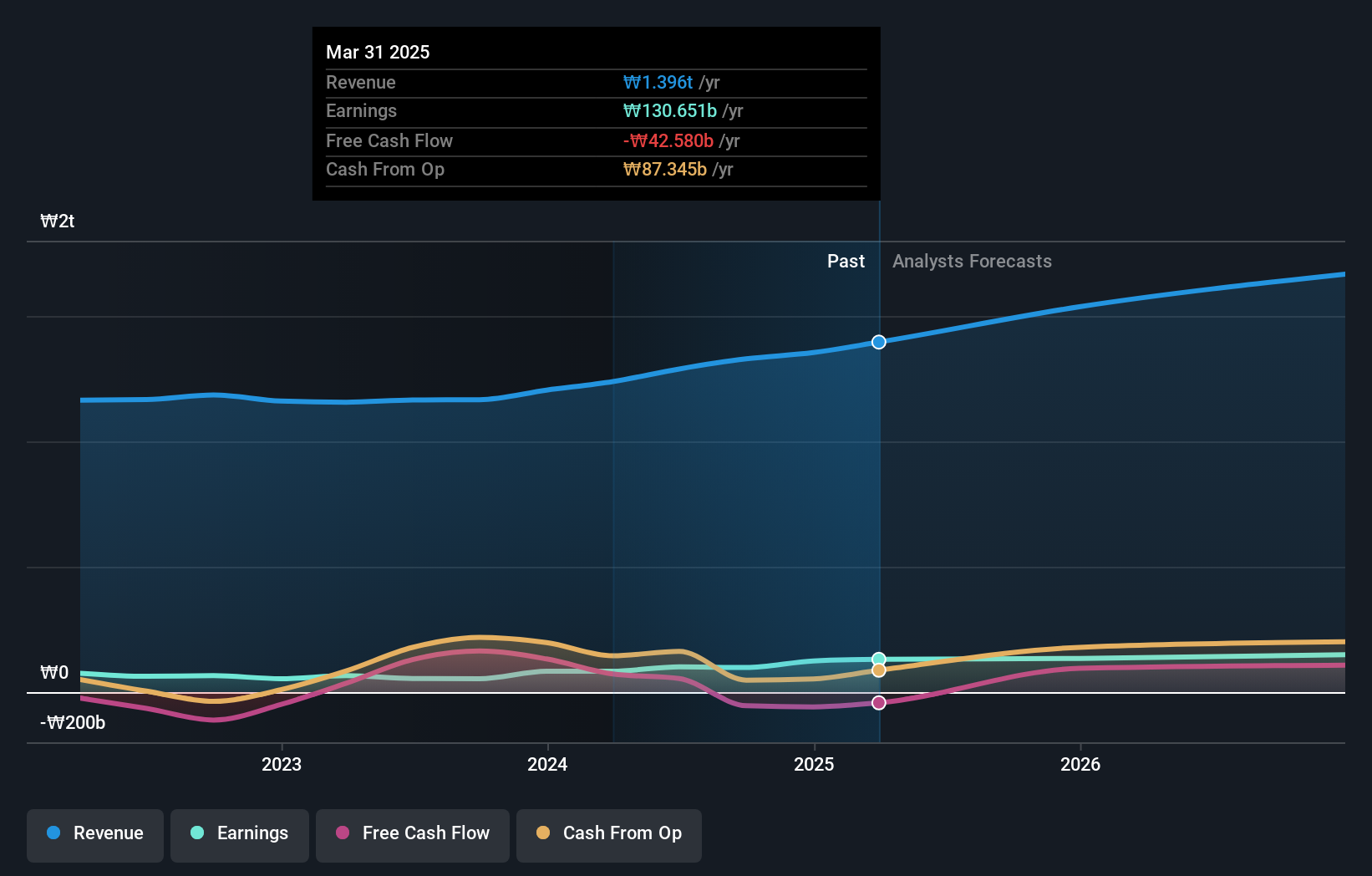

Operations: The company generates revenue primarily through the sale of goods, incurring significant costs of goods sold (COGS) which typically account for the largest expense. Its operations also involve substantial operating expenses, including sales & marketing and research & development efforts to support its business activities.

Kyung Dong Navien, a lesser-known yet robust player in the building industry, has demonstrated notable financial performance. With a year-over-year earnings growth of 28%, it surpasses the industry average of 16%. Its price-to-earnings ratio stands attractively at 10.5, below South Korea's market average of 12.2. Furthermore, its net debt to equity ratio has improved significantly from 42% to just under 2% over five years, reflecting strong financial health and management efficiency.

- Click to explore a detailed breakdown of our findings in Kyung Dong Navien's health report.

Assess Kyung Dong Navien's past performance with our detailed historical performance reports.

Taking Advantage

- Reveal the 205 hidden gems among our KRX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyung Dong Navien might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A009450

Kyung Dong Navien

Manufactures and sells machinery and heat combustion equipment in South Korea.

Flawless balance sheet with solid track record.