- South Korea

- /

- Machinery

- /

- KOSDAQ:A089140

NEXTURNBIOSCIENCE Co., Ltd.'s (KOSDAQ:089140) 38% Share Price Plunge Could Signal Some Risk

NEXTURNBIOSCIENCE Co., Ltd. (KOSDAQ:089140) shares have had a horrible month, losing 38% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 39% in that time.

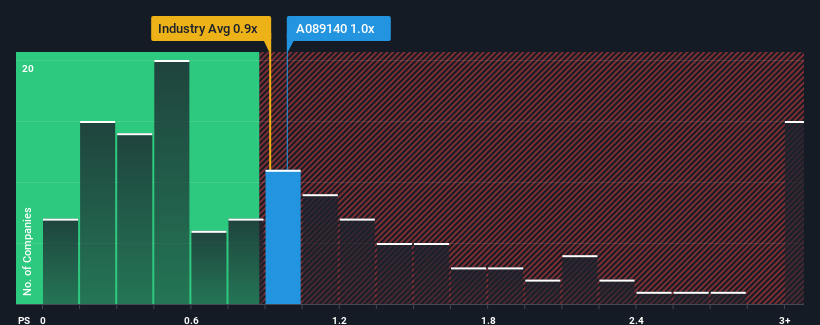

In spite of the heavy fall in price, it's still not a stretch to say that NEXTURNBIOSCIENCE's price-to-sales (or "P/S") ratio of 1x right now seems quite "middle-of-the-road" compared to the Machinery industry in Korea, where the median P/S ratio is around 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for NEXTURNBIOSCIENCE

What Does NEXTURNBIOSCIENCE's P/S Mean For Shareholders?

For example, consider that NEXTURNBIOSCIENCE's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for NEXTURNBIOSCIENCE, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, NEXTURNBIOSCIENCE would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 7.3% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 115% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

This is in contrast to the rest of the industry, which is expected to grow by 41% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that NEXTURNBIOSCIENCE's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does NEXTURNBIOSCIENCE's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for NEXTURNBIOSCIENCE looks to be in line with the rest of the Machinery industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that NEXTURNBIOSCIENCE's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with NEXTURNBIOSCIENCE (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

If you're unsure about the strength of NEXTURNBIOSCIENCE's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if NEXTURNBIOSCIENCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A089140

NEXTURNBIOSCIENCE

Manufactures and sells CNC automatic lathe machines in South Korea.

Excellent balance sheet and fair value.

Market Insights

Community Narratives