3 Stocks Estimated To Be Trading Up To 42.3% Below Intrinsic Value

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have experienced a notable rally, with major benchmarks reaching record highs as investors anticipate potential economic growth driven by policy changes. Amid these market dynamics, identifying undervalued stocks becomes increasingly important for investors seeking opportunities that may offer substantial value relative to their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Arteche Lantegi Elkartea (BME:ART) | €6.05 | €12.01 | 49.6% |

| Appier Group (TSE:4180) | ¥1670.00 | ¥3374.15 | 50.5% |

| XPEL (NasdaqCM:XPEL) | US$45.67 | US$91.12 | 49.9% |

| Cettire (ASX:CTT) | A$1.585 | A$2.94 | 46.1% |

| Mona YongpyongLtd (KOSE:A070960) | ₩3235.00 | ₩6711.45 | 51.8% |

| AirBoss of America (TSX:BOS) | CA$4.05 | CA$8.27 | 51% |

| KeePer Technical Laboratory (TSE:6036) | ¥3960.00 | ¥7787.76 | 49.2% |

| Redcentric (AIM:RCN) | £1.1625 | £2.32 | 50% |

| Nayuki Holdings (SEHK:2150) | HK$1.59 | HK$3.16 | 49.7% |

| QuinStreet (NasdaqGS:QNST) | US$23.42 | US$46.52 | 49.7% |

Let's dive into some prime choices out of the screener.

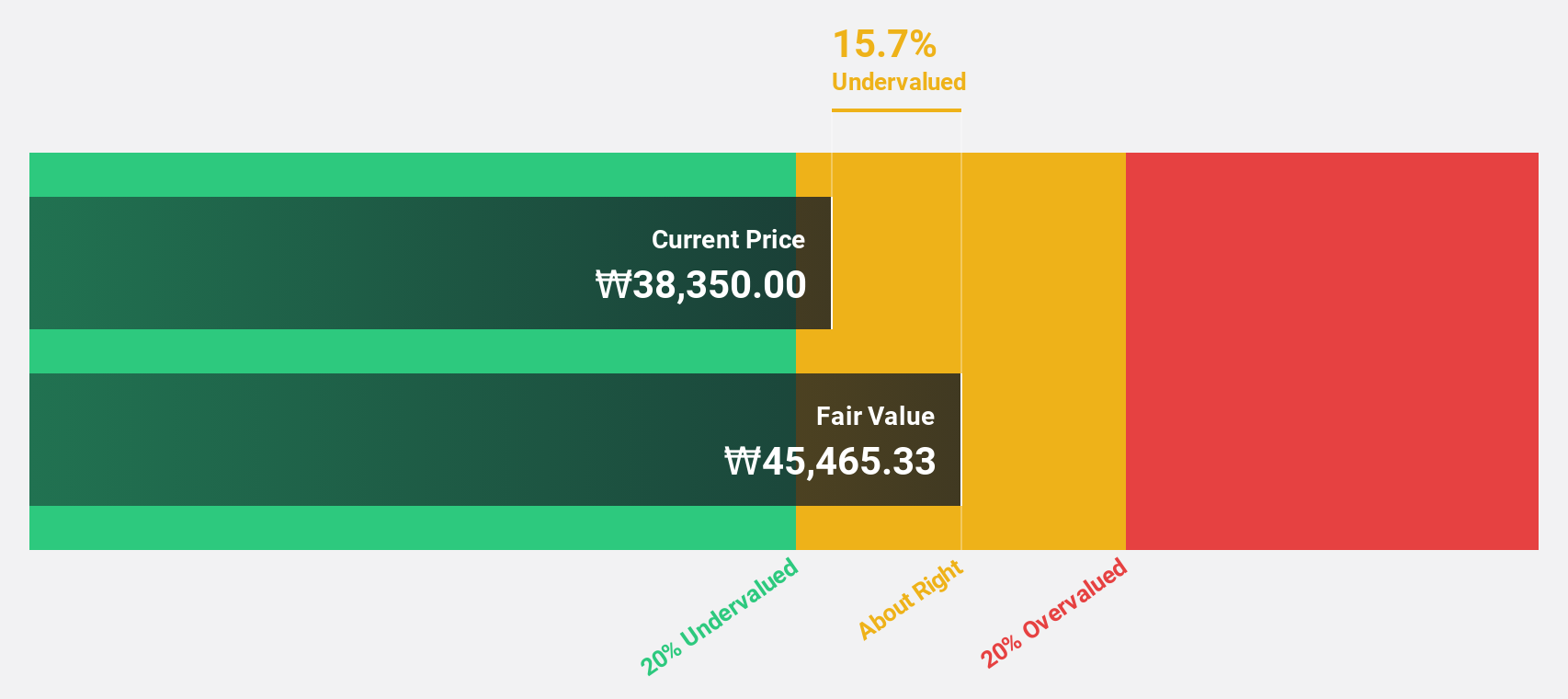

BHI (KOSDAQ:A083650)

Overview: BHI Co., Ltd. develops, manufactures, and supplies power plant equipment globally with a market cap of ₩400.70 billion.

Operations: Revenue Segments (in millions of ₩):

Estimated Discount To Fair Value: 35.9%

BHI Co., Ltd. is trading at ₩15,040, significantly below its estimated fair value of ₩23,453.66, indicating potential undervaluation based on cash flows. Despite a volatile share price recently and interest payments not well covered by earnings, BHI's revenue growth is forecasted to outpace the KR market at 22.7% annually. Recent inclusion in the S&P Global BMI Index and improved profitability further highlight its strong financial recovery and growth prospects.

- The analysis detailed in our BHI growth report hints at robust future financial performance.

- Take a closer look at BHI's balance sheet health here in our report.

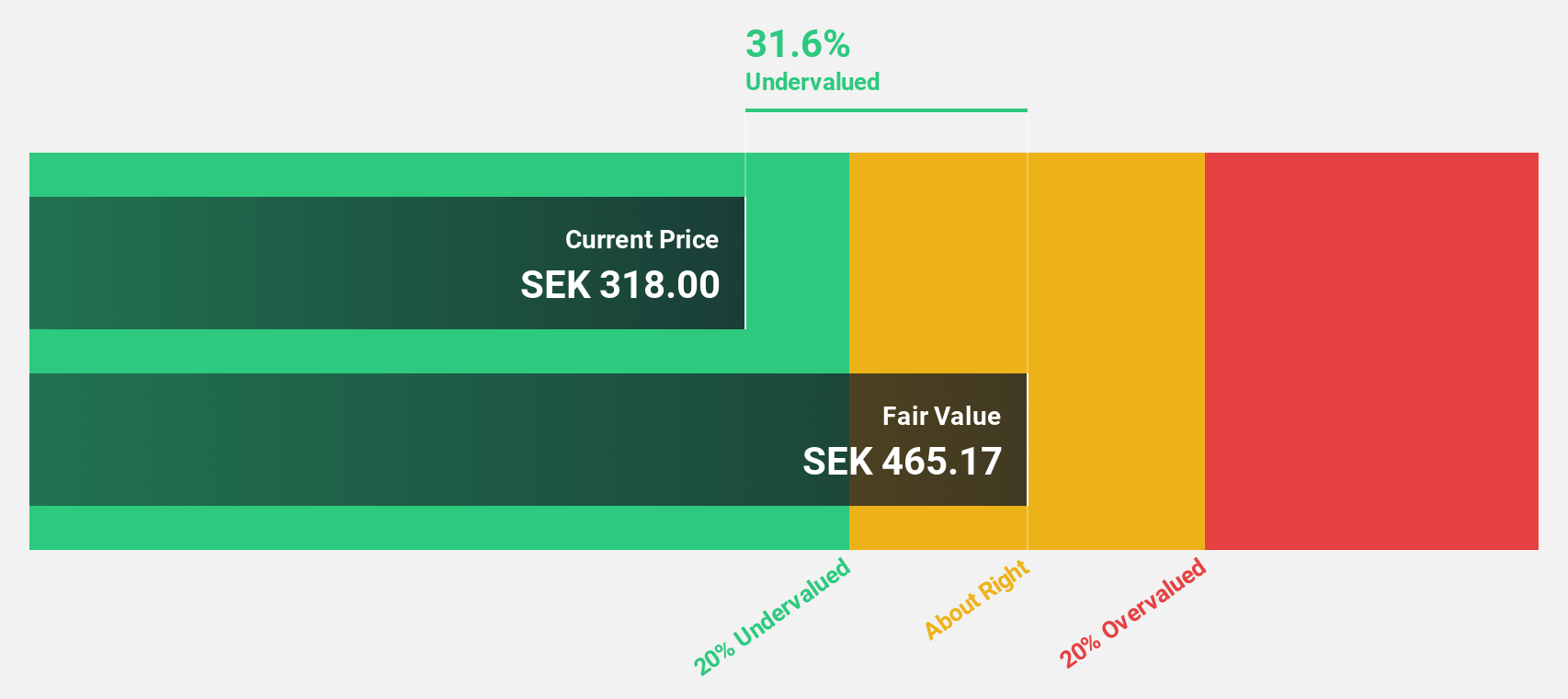

Xvivo Perfusion (OM:XVIVO)

Overview: Xvivo Perfusion AB (publ) is a medical technology company that develops and markets machines and perfusion solutions for assessing and maintaining organs for transplantation across various regions, with a market cap of SEK14.62 billion.

Operations: The company's revenue segments include Services at SEK81.19 million, Thoracic at SEK501.47 million, and Abdominal at SEK167.94 million.

Estimated Discount To Fair Value: 42.3%

Xvivo Perfusion is trading at SEK464, significantly below its estimated fair value of SEK804.55, highlighting potential undervaluation based on cash flows. The company reported strong financial results with third-quarter sales reaching SEK198.48 million and net income soaring to SEK85.82 million from SEK2.28 million a year ago. Earnings are forecast to grow significantly at 24% annually, outpacing the Swedish market's growth rate and supporting its undervaluation narrative despite low future return on equity expectations.

- Our expertly prepared growth report on Xvivo Perfusion implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Xvivo Perfusion with our comprehensive financial health report here.

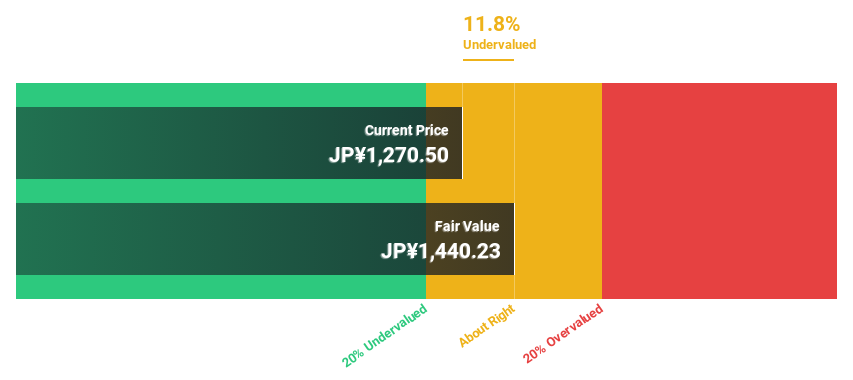

Nippon Kayaku (TSE:4272)

Overview: Nippon Kayaku Co., Ltd. is engaged in the development, manufacturing, and sale of functional chemicals, pharmaceuticals, safety systems, and agrochemicals both in Japan and internationally, with a market cap of ¥194.72 billion.

Operations: The company's revenue is derived from its Fine Chemicals segment at ¥59.50 billion, the Life Science Business Unit at ¥62.72 billion, and the Mobility & Imaging Business Unit at ¥84.83 billion.

Estimated Discount To Fair Value: 12%

Nippon Kayaku is trading at ¥1,256, slightly below its estimated fair value of ¥1,427.27, suggesting potential undervaluation based on cash flows. Earnings are expected to grow significantly by 34.4% annually over the next three years, surpassing the JP market's growth rate. However, profit margins have decreased from 5.9% to 2.4%. A recent share buyback plan worth ¥7 billion indicates strategic capital management amid evolving business conditions.

- In light of our recent growth report, it seems possible that Nippon Kayaku's financial performance will exceed current levels.

- Click here to discover the nuances of Nippon Kayaku with our detailed financial health report.

Key Takeaways

- Click this link to deep-dive into the 901 companies within our Undervalued Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Kayaku might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4272

Nippon Kayaku

Develops, manufactures, and sells functional chemicals, pharmaceuticals, safety systems, and agrochemicals and other products in Japan and internationally.

Excellent balance sheet with reasonable growth potential.