- South Korea

- /

- Machinery

- /

- KOSDAQ:A068240

If You Had Bought DawonsysLtd (KOSDAQ:068240) Stock A Year Ago, You Could Pocket A 19% Gain Today

We believe investing is smart because history shows that stock markets go higher in the long term. But not every stock you buy will perform as well as the overall market. Over the last year the Dawonsys Co.,Ltd. (KOSDAQ:068240) share price is up 19%, but that's less than the broader market return. Zooming out, the stock is actually down 5.5% in the last three years.

View our latest analysis for DawonsysLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months, DawonsysLtd actually shrank its EPS by 52%.

This means it's unlikely the market is judging the company based on earnings growth. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

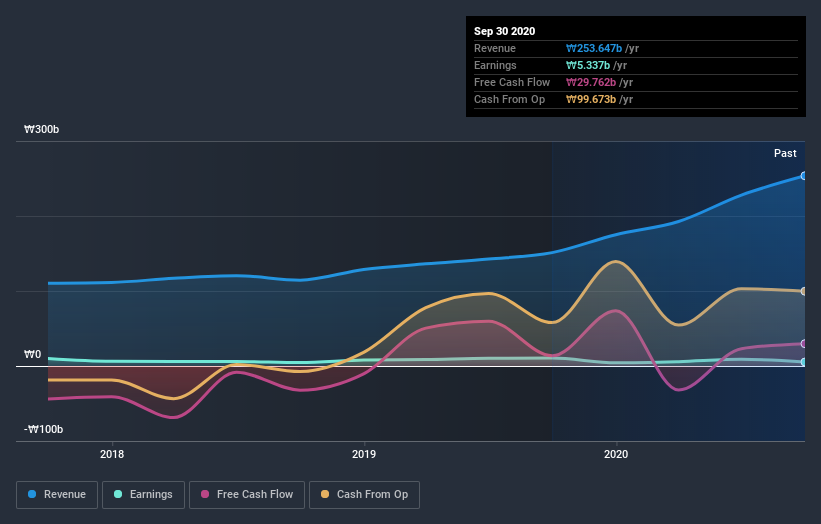

We are skeptical of the suggestion that the 0.5% dividend yield would entice buyers to the stock. We think that the revenue growth of 67% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at DawonsysLtd's financial health with this free report on its balance sheet.

A Different Perspective

DawonsysLtd provided a TSR of 20% over the last twelve months. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 2% over half a decade It is possible that returns will improve along with the business fundamentals. It's always interesting to track share price performance over the longer term. But to understand DawonsysLtd better, we need to consider many other factors. Even so, be aware that DawonsysLtd is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading DawonsysLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A068240

DawonsysLtd

Engages in the rolling stock, fusion power supply and accelerator, display and semiconductor, plant, and environment-friendly system businesses in South Korea and internationally.

Low risk and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.