- South Korea

- /

- Machinery

- /

- KOSDAQ:A048770

TPC Mechatronics'(KOSDAQ:048770) Share Price Is Down 38% Over The Past Three Years.

As an investor its worth striving to ensure your overall portfolio beats the market average. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term TPC Mechatronics Corporation (KOSDAQ:048770) shareholders have had that experience, with the share price dropping 38% in three years, versus a market return of about 33%. Unhappily, the share price slid 2.3% in the last week.

Check out our latest analysis for TPC Mechatronics

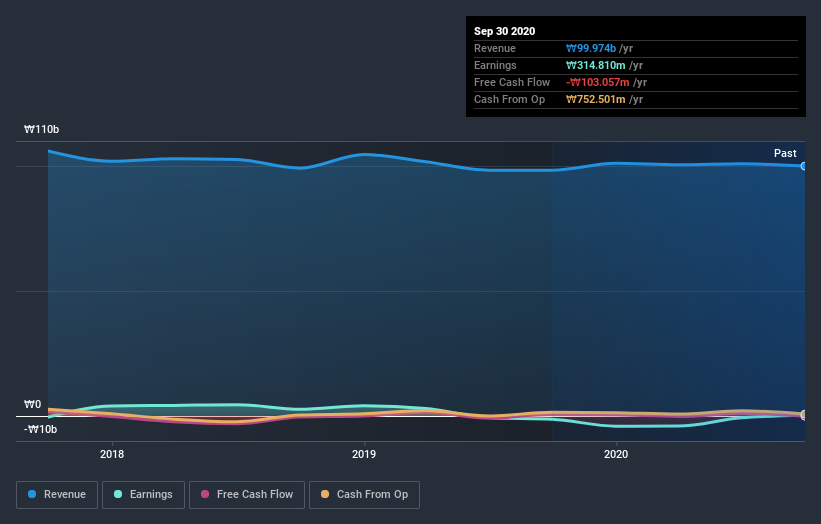

Given that TPC Mechatronics only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last three years, TPC Mechatronics' revenue dropped 1.4% per year. That's not what investors generally want to see. The annual decline of 11% per year in that period has clearly disappointed holders. That makes sense given the lack of either profits or revenue growth. Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at TPC Mechatronics' financial health with this free report on its balance sheet.

A Different Perspective

TPC Mechatronics shareholders gained a total return of 27% during the year. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 4% endured over half a decade. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - TPC Mechatronics has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade TPC Mechatronics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TPC Mechatronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A048770

TPC Mechatronics

Primarily manufactures and sells pneumatic equipment in South Korea and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives