- South Korea

- /

- Electrical

- /

- KOSDAQ:A042370

Income Investors Should Know That Vitzro Tech Co. Ltd (KOSDAQ:042370) Goes Ex-Dividend Soon

Readers hoping to buy Vitzro Tech Co. Ltd (KOSDAQ:042370) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Ex-dividend means that investors that purchase the stock on or after the 29th of December will not receive this dividend, which will be paid on the 20th of April.

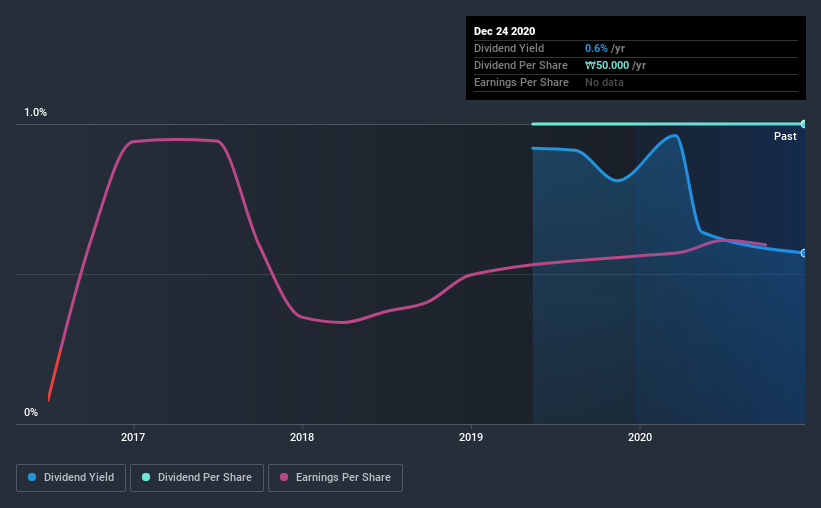

Vitzro Tech's next dividend payment will be ₩50.00 per share, and in the last 12 months, the company paid a total of ₩50.00 per share. Looking at the last 12 months of distributions, Vitzro Tech has a trailing yield of approximately 0.6% on its current stock price of ₩8770. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

View our latest analysis for Vitzro Tech

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Vitzro Tech has a low and conservative payout ratio of just 6.0% of its income after tax. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Luckily it paid out just 18% of its free cash flow last year.

It's positive to see that Vitzro Tech's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Vitzro Tech paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That's why it's not ideal to see Vitzro Tech's earnings per share have been shrinking at 3.1% a year over the previous five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. It looks like the Vitzro Tech dividends are largely the same as they were two years ago. When earnings are declining yet the dividends are flat, typically the company is either paying out a higher portion of its earnings, or paying out of cash or debt on the balance sheet, neither of which is ideal.

The Bottom Line

Has Vitzro Tech got what it takes to maintain its dividend payments? Earnings per share are down meaningfully, although at least the company is paying out a low and conservative percentage of both its earnings and cash flow. It's definitely not great to see earnings falling, but at least there may be some buffer before the dividend needs to be cut. Overall, it's not a bad combination, but we feel that there are likely more attractive dividend prospects out there.

Curious about whether Vitzro Tech has been able to consistently generate growth? Here's a chart of its historical revenue and earnings growth.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Vitzro Tech, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A042370

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives