- South Korea

- /

- Construction

- /

- KOSDAQ:A026150

Shareholders Of Tuksu Engineering & ConstructionLtd (KOSDAQ:026150) Must Be Happy With Their 137% Total Return

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, you can make far more than 100% on a really good stock. For instance, the price of Tuksu Engineering & Construction,Ltd. (KOSDAQ:026150) stock is up an impressive 104% over the last five years. Also pleasing for shareholders was the 10% gain in the last three months. But this could be related to the strong market, which is up 9.0% in the last three months.

See our latest analysis for Tuksu Engineering & ConstructionLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

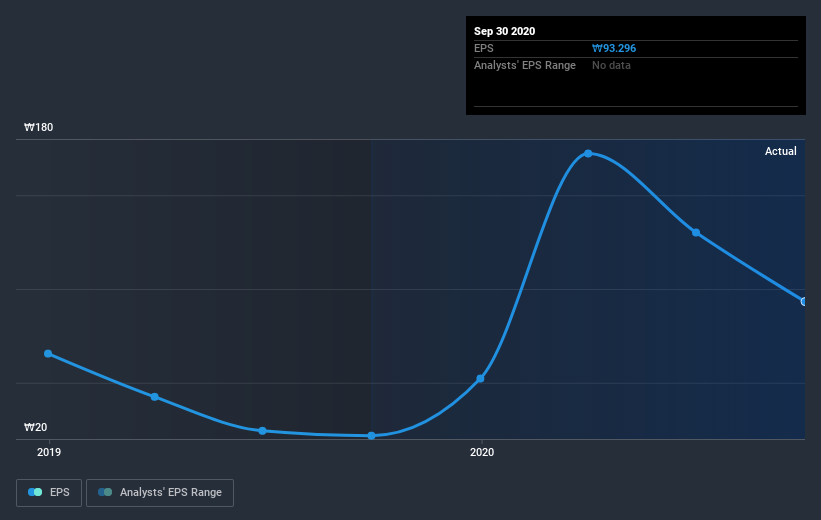

During the last half decade, Tuksu Engineering & ConstructionLtd became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. Indeed, the Tuksu Engineering & ConstructionLtd share price has gained 47% in three years. During the same period, EPS grew by 28% each year. This EPS growth is higher than the 14% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock, these days. Having said that, the market is still optimistic, given the P/E ratio of 79.10.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We've already covered Tuksu Engineering & ConstructionLtd's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Tuksu Engineering & ConstructionLtd hasn't been paying dividends, but its TSR of 137% exceeds its share price return of 104%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Tuksu Engineering & ConstructionLtd shareholders gained a total return of 30% during the year. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 19% per year over five year. This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand Tuksu Engineering & ConstructionLtd better, we need to consider many other factors. For instance, we've identified 1 warning sign for Tuksu Engineering & ConstructionLtd that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Tuksu Engineering & ConstructionLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tuksu Engineering & ConstructionLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A026150

Tuksu Engineering & ConstructionLtd

Operates as an engineering and construction company in South Korea and internationally.

Adequate balance sheet with questionable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026