- South Korea

- /

- Electrical

- /

- KOSDAQ:A019990

Enertork Ltd.'s (KOSDAQ:019990) Price Is Out Of Tune With Revenues

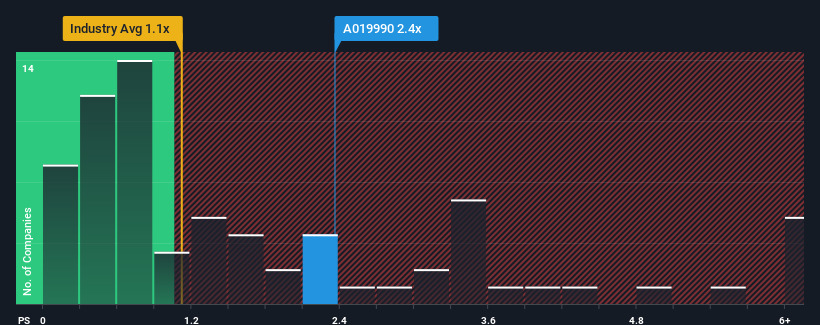

When you see that almost half of the companies in the Electrical industry in Korea have price-to-sales ratios (or "P/S") below 1.1x, Enertork Ltd. (KOSDAQ:019990) looks to be giving off some sell signals with its 2.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Enertork

What Does Enertork's Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Enertork's revenue has been unimpressive. Perhaps the market believes that revenue growth will improve markedly over current levels, inflating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Enertork's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

Enertork's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 11% overall rise in revenue. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

It's interesting to note that the rest of the industry is similarly expected to grow by 2.7% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's curious that Enertork's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

What We Can Learn From Enertork's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We didn't expect to see Enertork trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You should always think about risks. Case in point, we've spotted 2 warning signs for Enertork you should be aware of, and 1 of them can't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Enertork might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A019990

Enertork

Manufactures and sells electric actuators and worm gear boxes in South Korea.

Excellent balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026