- South Korea

- /

- Electrical

- /

- KOSDAQ:A017510

Semyung Electric Machinery Co.,Ltd (KOSDAQ:017510) Looks Just Right With A 29% Price Jump

Semyung Electric Machinery Co.,Ltd (KOSDAQ:017510) shares have continued their recent momentum with a 29% gain in the last month alone. The last month tops off a massive increase of 128% in the last year.

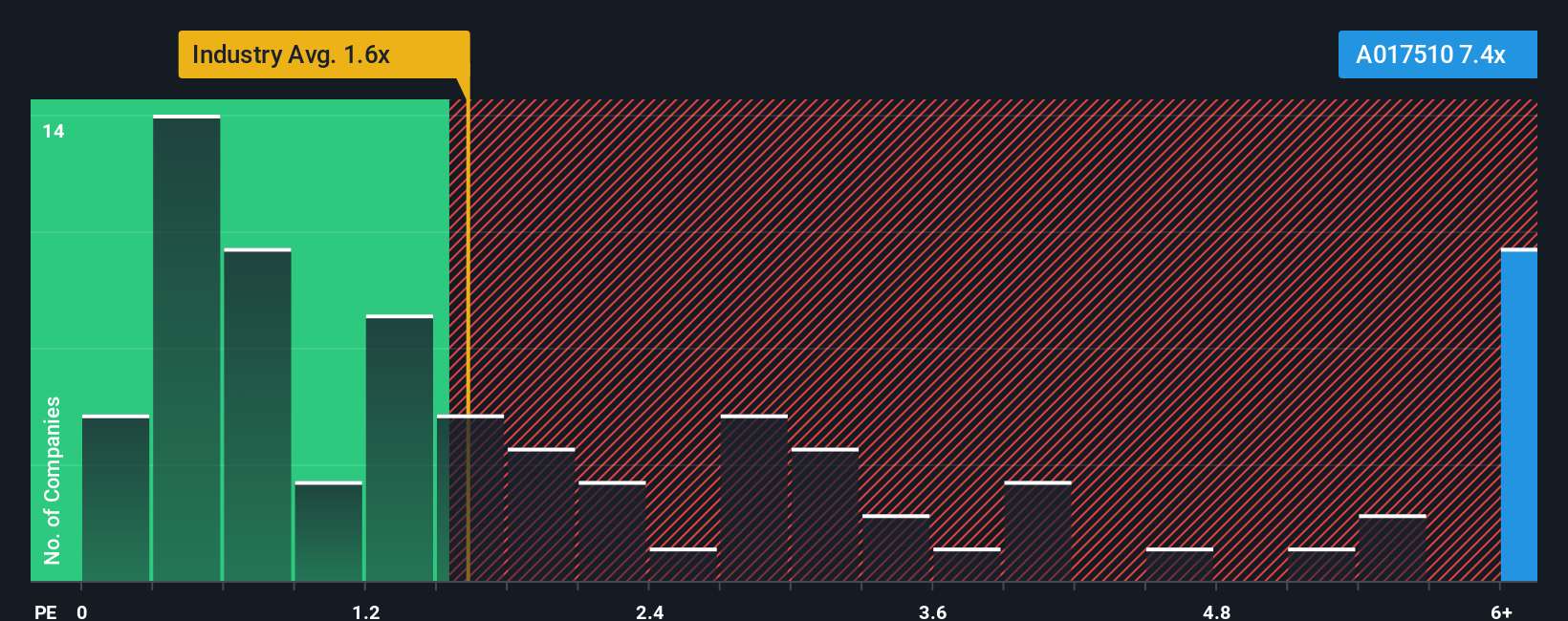

After such a large jump in price, you could be forgiven for thinking Semyung Electric MachineryLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 7.4x, considering almost half the companies in Korea's Electrical industry have P/S ratios below 1.6x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Semyung Electric MachineryLtd

What Does Semyung Electric MachineryLtd's P/S Mean For Shareholders?

Semyung Electric MachineryLtd certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Semyung Electric MachineryLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Semyung Electric MachineryLtd's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 79% gain to the company's top line. Pleasingly, revenue has also lifted 91% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 14%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Semyung Electric MachineryLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Semyung Electric MachineryLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Semyung Electric MachineryLtd maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Semyung Electric MachineryLtd you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A017510

Semyung Electric MachineryLtd

Manufactures and sells transmission and distribution lines, railway products, and automobile parts in South Korea and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives