- South Korea

- /

- Building

- /

- KOSDAQ:A014620

Sung Kwang Bend Co.,Ltd. (KOSDAQ:014620) Stock Rockets 26% But Many Are Still Ignoring The Company

Sung Kwang Bend Co.,Ltd. (KOSDAQ:014620) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 35% in the last year.

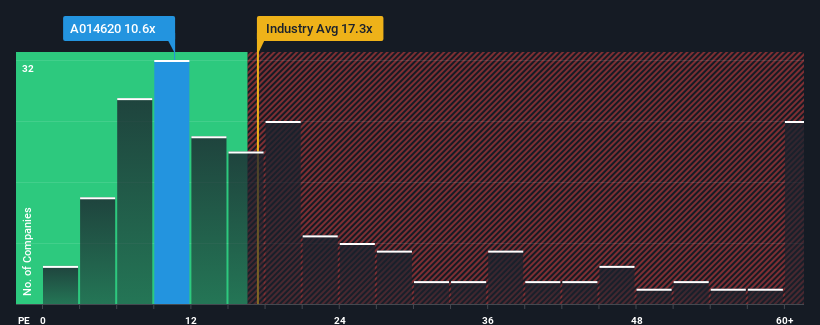

Even after such a large jump in price, there still wouldn't be many who think Sung Kwang BendLtd's price-to-earnings (or "P/E") ratio of 10.6x is worth a mention when the median P/E in Korea is similar at about 11x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, Sung Kwang BendLtd has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Sung Kwang BendLtd

How Is Sung Kwang BendLtd's Growth Trending?

In order to justify its P/E ratio, Sung Kwang BendLtd would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 30%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 20% per annum as estimated by the five analysts watching the company. That's shaping up to be materially higher than the 15% per annum growth forecast for the broader market.

With this information, we find it interesting that Sung Kwang BendLtd is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Sung Kwang BendLtd's P/E?

Sung Kwang BendLtd's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Sung Kwang BendLtd currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Sung Kwang BendLtd with six simple checks on some of these key factors.

You might be able to find a better investment than Sung Kwang BendLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A014620

Sung Kwang BendLtd

Engages in the manufacture and sale of pipe fittings worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives