- South Korea

- /

- Machinery

- /

- KOSDAQ:A007820

SMCore.Inc's (KOSDAQ:007820) 34% Price Boost Is Out Of Tune With Revenues

SMCore.Inc (KOSDAQ:007820) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 6.6% isn't as impressive.

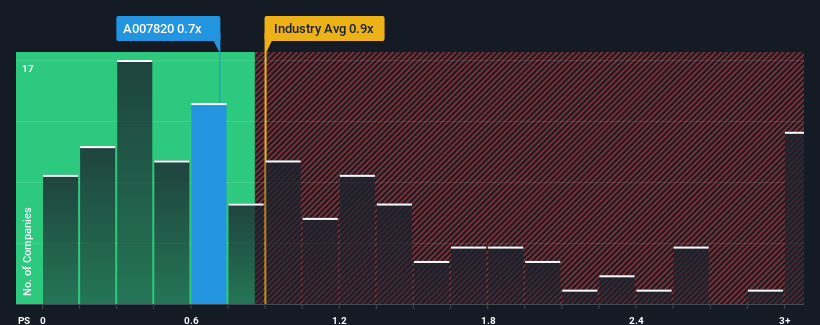

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about SMCore.Inc's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in Korea is also close to 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for SMCore.Inc

What Does SMCore.Inc's P/S Mean For Shareholders?

SMCore.Inc has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on SMCore.Inc will help you shine a light on its historical performance.How Is SMCore.Inc's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like SMCore.Inc's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. The latest three year period has also seen an excellent 108% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 37% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that SMCore.Inc's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does SMCore.Inc's P/S Mean For Investors?

SMCore.Inc appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of SMCore.Inc revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

There are also other vital risk factors to consider and we've discovered 2 warning signs for SMCore.Inc (1 is concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on SMCore.Inc, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A007820

SMCore.Inc

Manufactures and sells smart automation systems in South Korea and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives