- South Korea

- /

- Insurance

- /

- KOSE:A000370

Top KRX Dividend Stocks To Consider In October 2024

Reviewed by Simply Wall St

The South Korean market has shown resilience with a 1.3% increase over the last week and a 4.1% rise in the past year, while earnings are projected to grow by 30% annually in the coming years. In this dynamic environment, dividend stocks can offer investors potential stability and income, making them an attractive consideration for those looking to benefit from both growth prospects and steady returns.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.56% | ★★★★★★ |

| Kangwon Land (KOSE:A035250) | 5.64% | ★★★★★☆ |

| Woori Financial Group (KOSE:A316140) | 4.50% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.43% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.19% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.96% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.43% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.79% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.13% | ★★★★★☆ |

| ORION Holdings (KOSE:A001800) | 4.72% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our Top KRX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

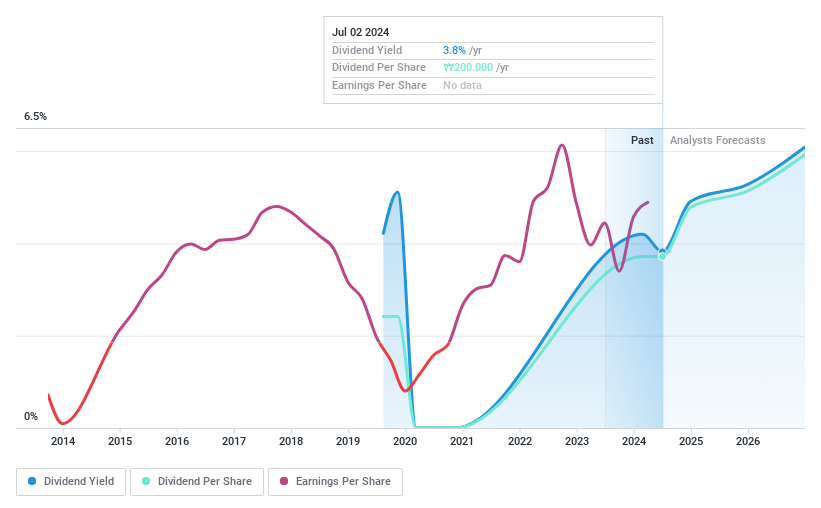

Hanwha General Insurance (KOSE:A000370)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanwha General Insurance Co., Ltd. offers insurance services in South Korea and has a market cap of approximately ₩581.57 billion.

Operations: Hanwha General Insurance Co., Ltd. operates in the insurance sector within South Korea.

Dividend Yield: 4%

Hanwha General Insurance offers a compelling dividend profile, trading at 90.6% below its estimated fair value and providing a dividend yield in the top 25% of the South Korean market. Its low payout ratios—11.2% earnings and 1.4% cash flow—suggest dividends are well-covered, though its track record is less stable, with only five years of payments marked by volatility. Recent earnings growth supports potential future payouts despite past inconsistencies in dividend reliability.

- Navigate through the intricacies of Hanwha General Insurance with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Hanwha General Insurance is trading behind its estimated value.

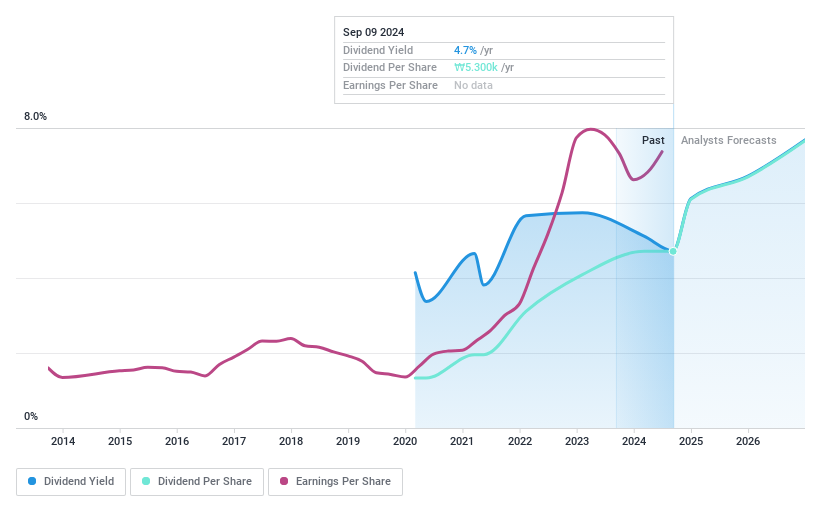

DB Insurance (KOSE:A005830)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DB Insurance Co., Ltd. operates as a provider of various insurance products and services in South Korea, with a market cap of ₩6.72 trillion.

Operations: DB Insurance Co., Ltd.'s revenue is primarily generated from its Non-Life Insurance Sector at ₩19.87 billion, followed by the Life Insurance Sector at ₩1.60 billion, and the Installment Finance Sector contributing ₩39.26 million.

Dividend Yield: 4.7%

DB Insurance trades at 84.9% below its estimated fair value, offering a dividend yield in the top 25% of the Korean market. With a payout ratio of 16.4% and cash payout ratio of 6.8%, dividends are well-covered by earnings and cash flows, respectively. Although payments have been stable, DB Insurance has only paid dividends for five years, indicating a limited but growing track record in dividend reliability and sustainability.

- Unlock comprehensive insights into our analysis of DB Insurance stock in this dividend report.

- According our valuation report, there's an indication that DB Insurance's share price might be on the cheaper side.

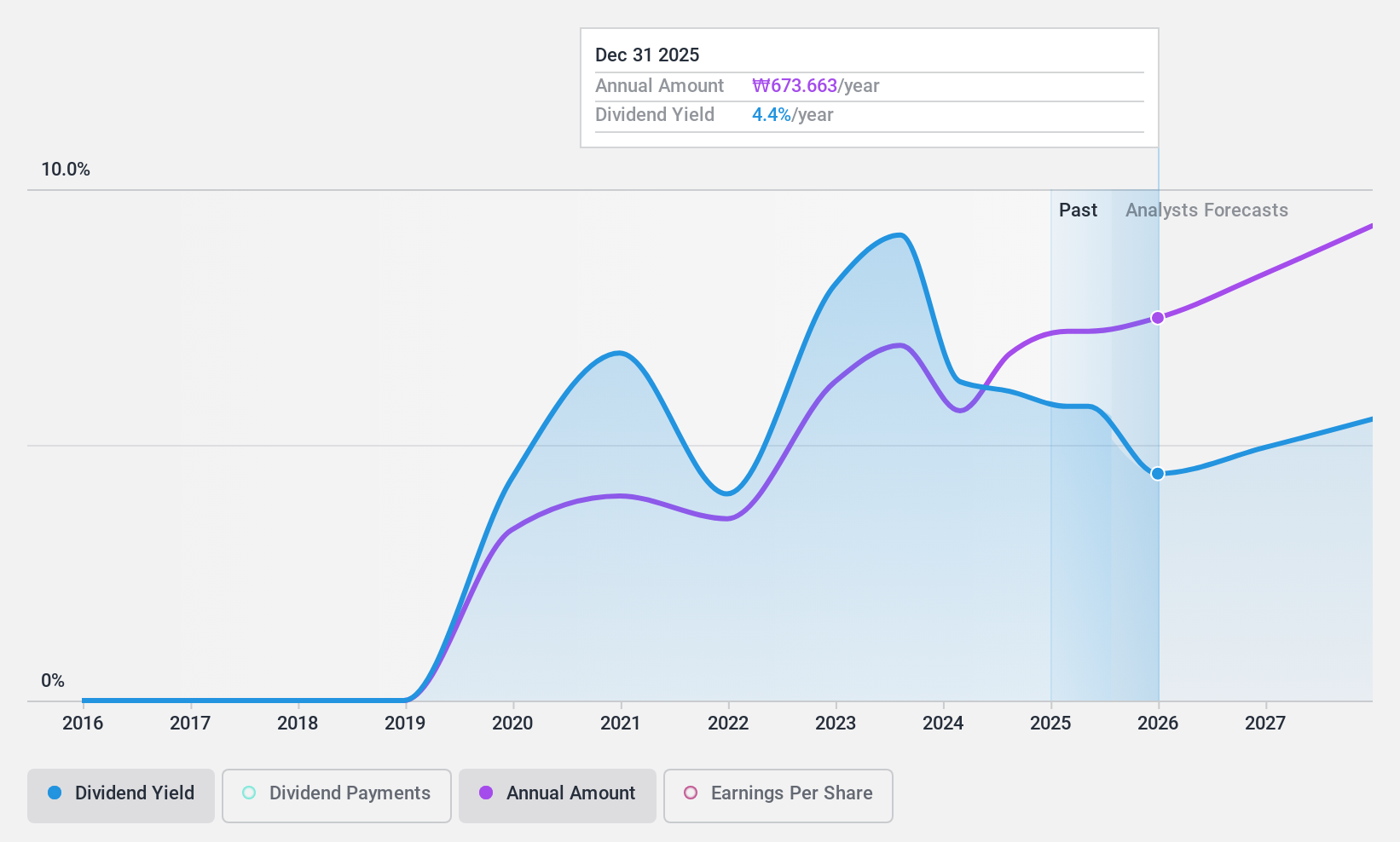

BNK Financial Group (KOSE:A138930)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BNK Financial Group Inc., along with its subsidiaries, offers a range of financial products and services both in South Korea and internationally, with a market cap of ₩2.95 trillion.

Operations: BNK Financial Group Inc.'s revenue segments include Busan Bank with ₩1.30 trillion, Gyeongnam Bank at ₩974.64 billion, BNK Capital generating ₩206.99 billion, BNK Investment Securities contributing ₩155.86 billion, and BNK Savings Bank at ₩38.85 billion.

Dividend Yield: 8.9%

BNK Financial Group offers a dividend yield in the top 25% of the Korean market, with a payout ratio of 25.5%, indicating strong coverage by earnings. Despite having paid dividends for only five years, payments have been stable and growing. Recent buyback activity enhances shareholder value, with KRW 12.99 billion spent on repurchases as of August 2024. Trading at a significant discount to estimated fair value, BNK presents potential for dividend-focused investors seeking value.

- Click to explore a detailed breakdown of our findings in BNK Financial Group's dividend report.

- Our valuation report unveils the possibility BNK Financial Group's shares may be trading at a discount.

Where To Now?

- Reveal the 75 hidden gems among our Top KRX Dividend Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanwha General Insurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000370

Flawless balance sheet, undervalued and pays a dividend.